The Closing Bell: Robinhood Support Flunks My Responsible Gaming Test

Prediction markets roundup: Updates in Maryland and Nevada Kalshi lawsuits; CFTC pick to get Senate hearing; Charles Schwab monitoring industry.

The Closing Bell is a roundup of prediction market news, analysis and other thoughts each Friday.

If you think you have a serious problem with sports betting at Robinhood, it doesn’t look like you’re going to get much help.

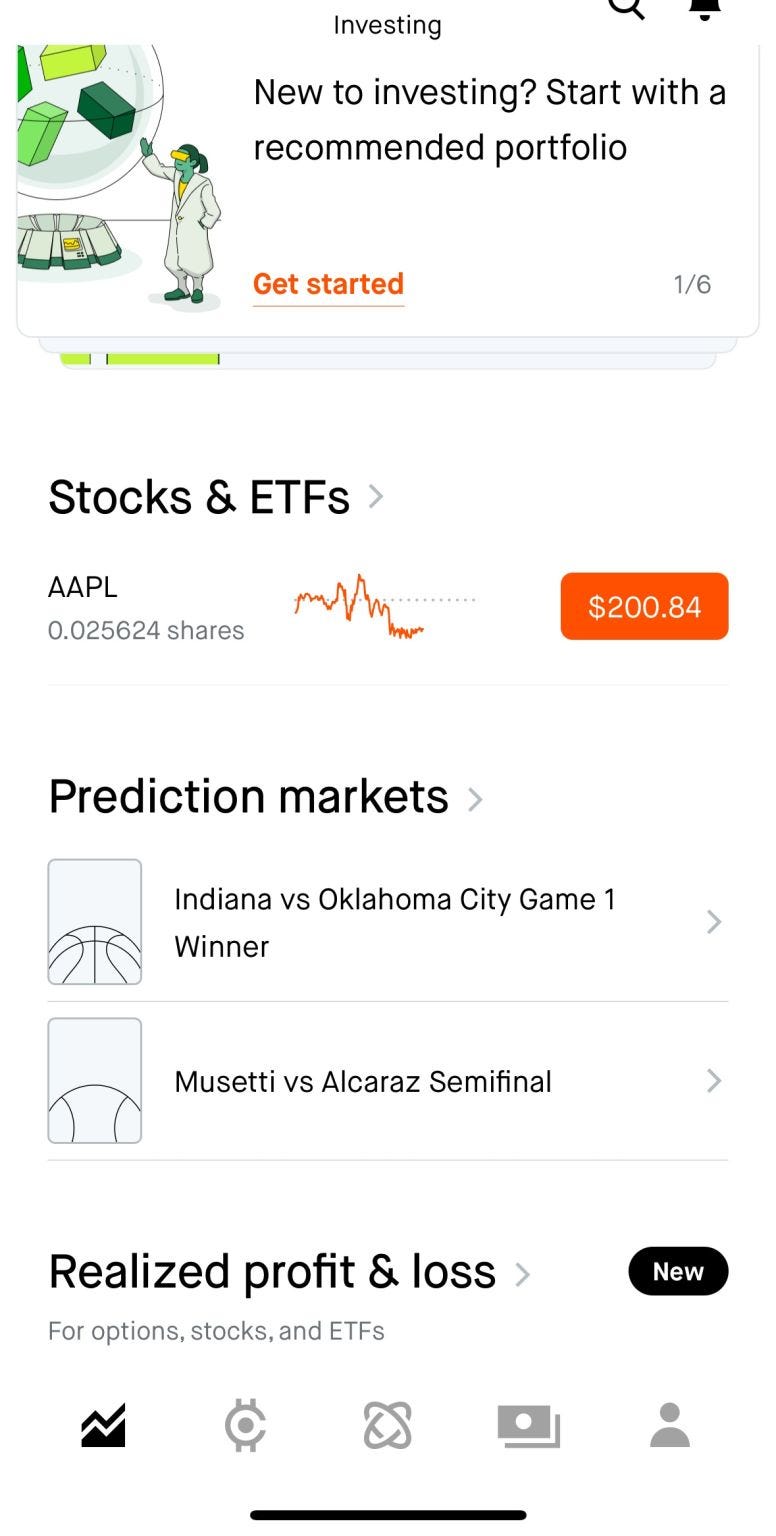

For starters, the home screen — at least for me — on Robinhood now includes single-game sports bets alongside stocks and everything else. Here’s what greeted me last night: You’re a click away from placing bets on Game 1 of the NBA finals and a French Open tennis match. This is one scroll down from the top and directly next to your stocks and ETFs. (Don’t make fun of my “portfolio”…all I did was deposit $50 and take Robinhood’s offer of $5 in free stocks):

This is, of course, kind of wild that Robinhood is surfacing these markets so prominently to users. I’ve pointed out the issues with Robinhood trying to be both a sports betting and financial platform in parallel in the past.

After I saw that, I asked a few pointed questions via Robinhood customer support to see how it might respond to someone with gambling issues. The responses are just a chatbot/AI at first contact, and you’d apparently get escalated to a real person in some instances. I was not escalated in either of the instances below.

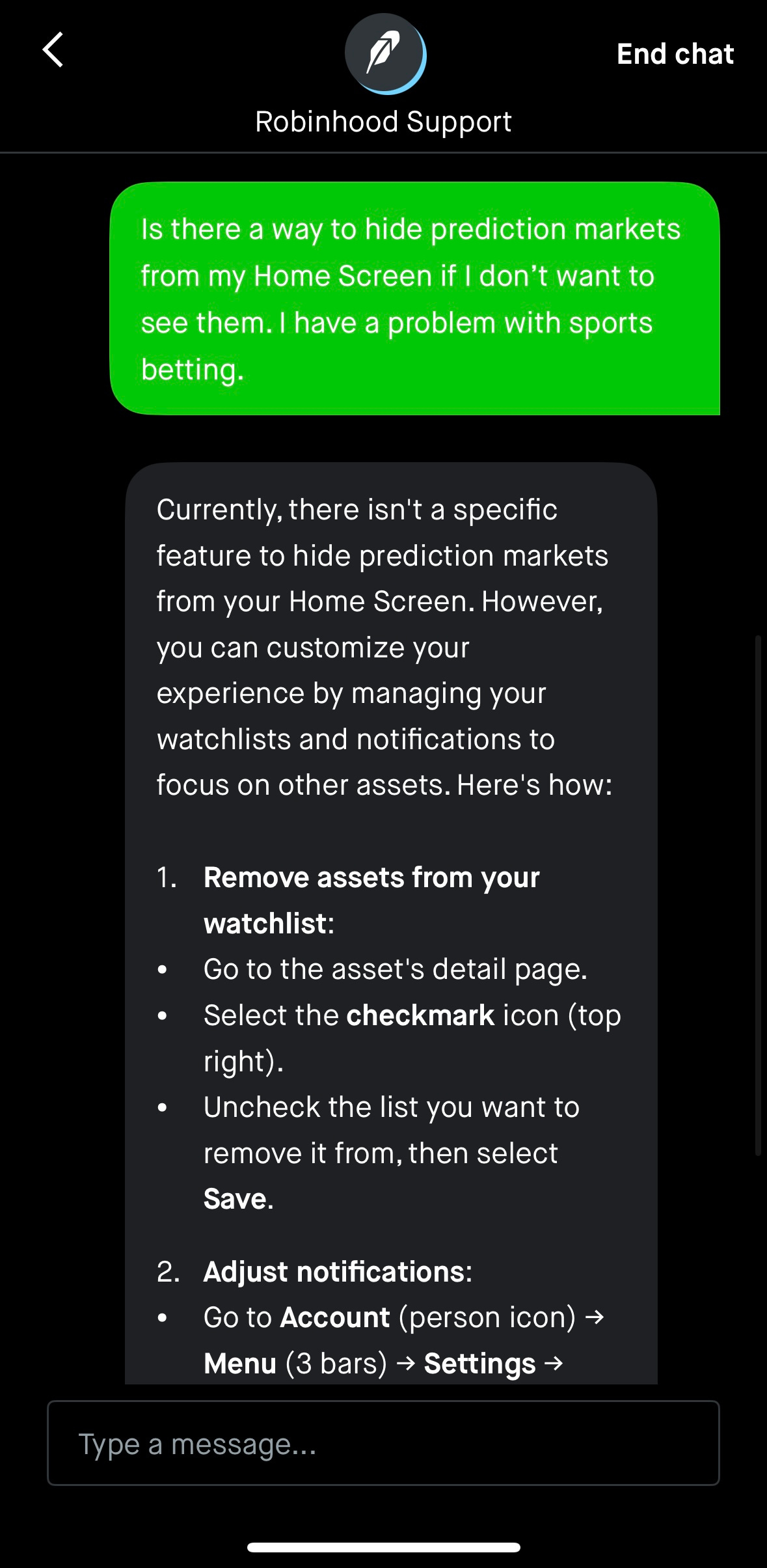

Here’s what Robinhood gave me when I gave it this prompt: “Is there a way to hide prediction markets from my Home Screen if I don’t want to see them. I have a problem with sports betting.” The answer:

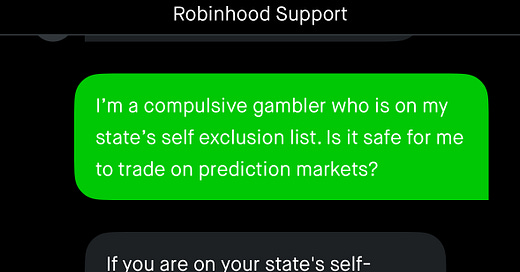

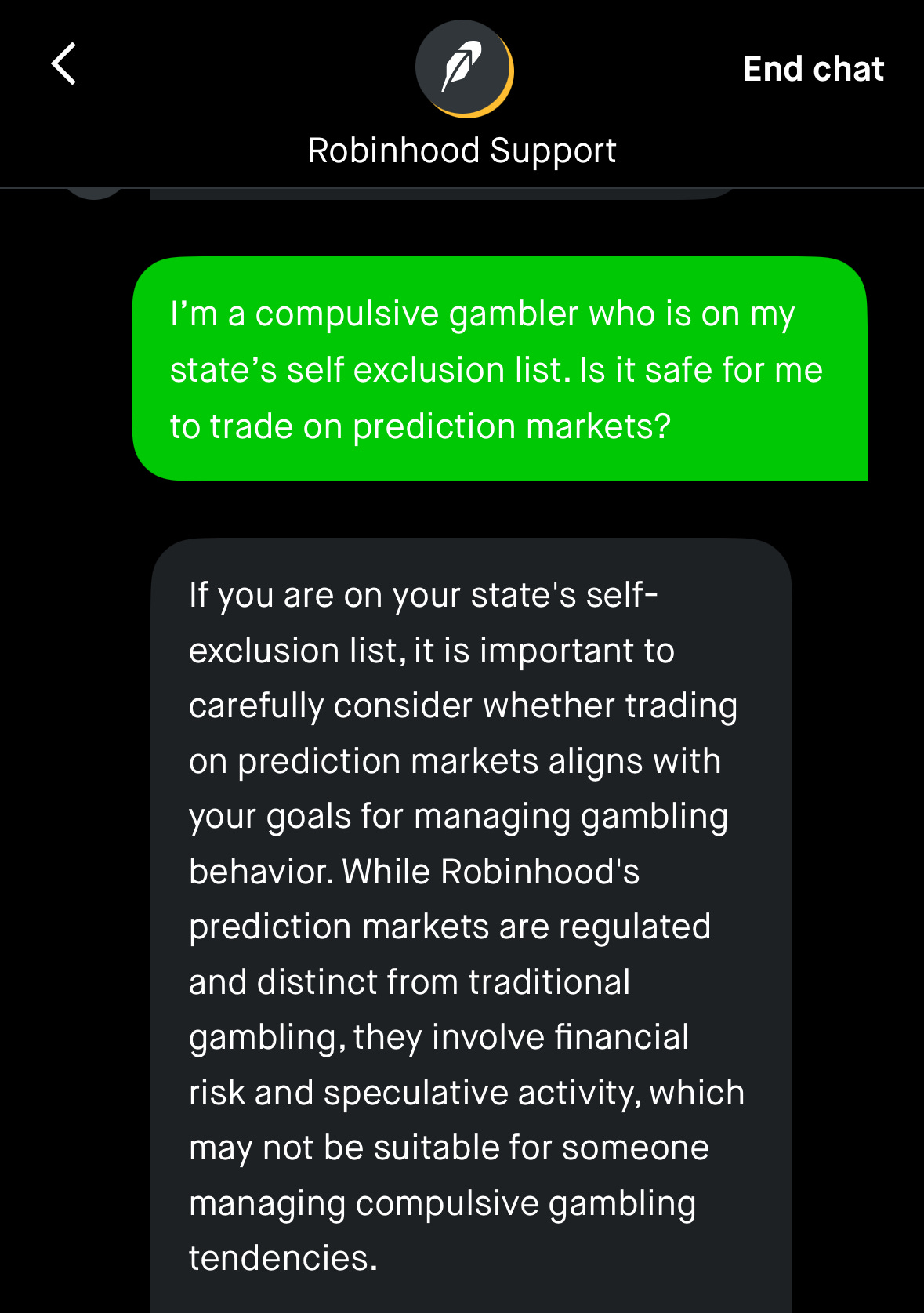

That seems not great. Later I prompted the chatbot with: “I’m a compulsive gambler who is on my state’s self exclusion list. Is it safe for me to trade on prediction markets?” The answer:

I understand Robinhood is kind of stuck saying this is not gambling on the legal front, but that’s also a conscious decision the company has made. I gave their support agent two pretty clear red flags, and if I truly were a problem gambler, I got very little tangible help from Robinhood.

Sometimes I feel too alarmist about my takes about prediction markets. But if this is the new normal — integrating moneylines and more in every investment and financial app — we’re heading toward a very dark place. And if that’s where we’re headed, I am probably not being alarmist enough…especially if this is Robinhood’s continued response to responsible gaming.

The rest of the roundup:

Maryland lawsuit update: Oral arguments took place last week in Kalshi’s lawsuit against Maryland (which is one of seven states that sent a cease-and-desist claiming Kalshi is offering illegal sports betting). We’ll have more on this on Monday from attorney Andrew Kim, who notes that arguments here didn’t go as well for Kalshi as they did in Nevada and New Jersey. But for now, here’s an interesting back-and-forth between the judge in the case and counsel for Kalshi on the idea that Kalshi now argues that sports events contracts should be allowed under the CFTC, when it argued in the now dead CFTC case that they should not be:

MR. HAVEMANN: …And that is sort of doubly proved by the fact that in the Special Rule itself, Congress contemplated that this sort of contract was, in fact, properly a swap.

THE COURT: So why did Kalshi say the opposite to the DC Circuit?

MR. HAVEMANN: I think Kalshi said to the DC Circuit that when Congress -- when Congress enacted the Special Rule in 2010, members of -- many members of Congress expected that these would not be approved. And I think that that is probably correct and I think it is not inconsistent with the position that we are taking here as Chief Judge Gordon in Nevada noted, as Judge Kiel in New Jersey noted. So it may be true that some sport events do not have economic consequences or potential economic consequences, but that is not true with respect to the events for which Kalshi offers contracts.

THE COURT: So I'm looking at your DC Circuit brief. The classic example of an event contract is a contract on the outcome of a sporting event. As the legislative history directly confirms, Congress did not want sports betting to be conducted on derivative markets.MR. HAVEMANN: I don't want to interrupt Your Honor.

THE COURT: No, I'm trying to understand -- and I don't know if this formally is a judicial estoppel issue, but it is potentially relevant that Kalshi took the position in one case when it suited it that these are swaps and then now is taking the position that they are swaps -- the other way around.

This dynamic may or may not end up mattering in court, but it remains terrible optics either way. More from Better Markets on this topic… Kalshi Draws Court Scrutiny for Major Reversal in Its Effort to Evade State Regulation of Sports Gambling Contracts: “In its recent lawsuit against the CFTC, in which Kalshi pushed to host bets on the outcome of political elections, Kalshi tried to justify the move by distinguishing that activity from pure gambling, like on sporting events. Kalshi, in that lawsuit, admitted that sports-event contracts are ‘gaming’ instruments lacking ‘financial, economic, or commercial’ consequences and therefore don’t generally belong on a regulated exchange like Kalshi’s. That was central to its claim that election gambling contracts are fundamentally different from sports wagers and should be allowed.”

Other state-level legal machinations:

Several things have happened in Nevada:

In news that should shock no one, the judge denied Nevada’s motion to dismiss. Kalshi’s lawsuit will continue.

The Nevada Resort Association will be allowed to intervene in the case, the judge ruled.

Crypto.com joined Kalshi in suing Nevada over sports event contracts.

Arizona had already sent a cease-and-desist to Kalshi; now it’s also sent a letter to the CFTC. Whole thing below, excerpt here: “The DCMs claim that, earlier this year, the CFTC allowed their sports outcome contracts to take effect without review or comment. Since then, the CFTC, at the last minute, cancelled a scheduled roundtable to discuss State and Tribal concerns. And, most recently, the CFTC dropped its appeal against Kalshi in the U.S. Court of Appeals for the D.C. Circuit. The CFTC’s inaction in enforcing its own rules, specifically, 17 CFR 40.11(a)(1), has prioritized the private business concerns of a handful of DCMs over the public’s interests. The State respectfully requests that the CFTC reconsider its actions and inaction in light of the State’s concerns and conclude that the DCMs’ offering of event contracts is gambling, is contrary to the public interest, and should be prohibited.'“

It does seem like a pretty big mess when you write it out like that.

Who does Kalshi keep in the Trump-Elon divorce?: It’s not clear that the very public spat between the president and Elon Musk would have any impact on Kalshi, but it is one of many companies that probably isn’t stoked that this is happening. That was confirmed by co-founder Luana Lopes Lara: “I feel like a child of divorce.” But both Trump and Musk have lauded Kalshi in the past…if a Trump vs. Musk market (see below) isn’t to their liking, is it feasible one of them sours on Kalshi? Stranger things have happened.

We still have no idea what happened in that xAI-Kalshi deal that was announced and then rescinded, but Mansour wrote this in since-deleted social media posts: “No one has fought for truth harder than Elon Musk. He has inspired me at every step.”

It’s interesting in retrospect to note that Kalshi’s general counsel left to work at the Department of Government Efficiency under Musk.

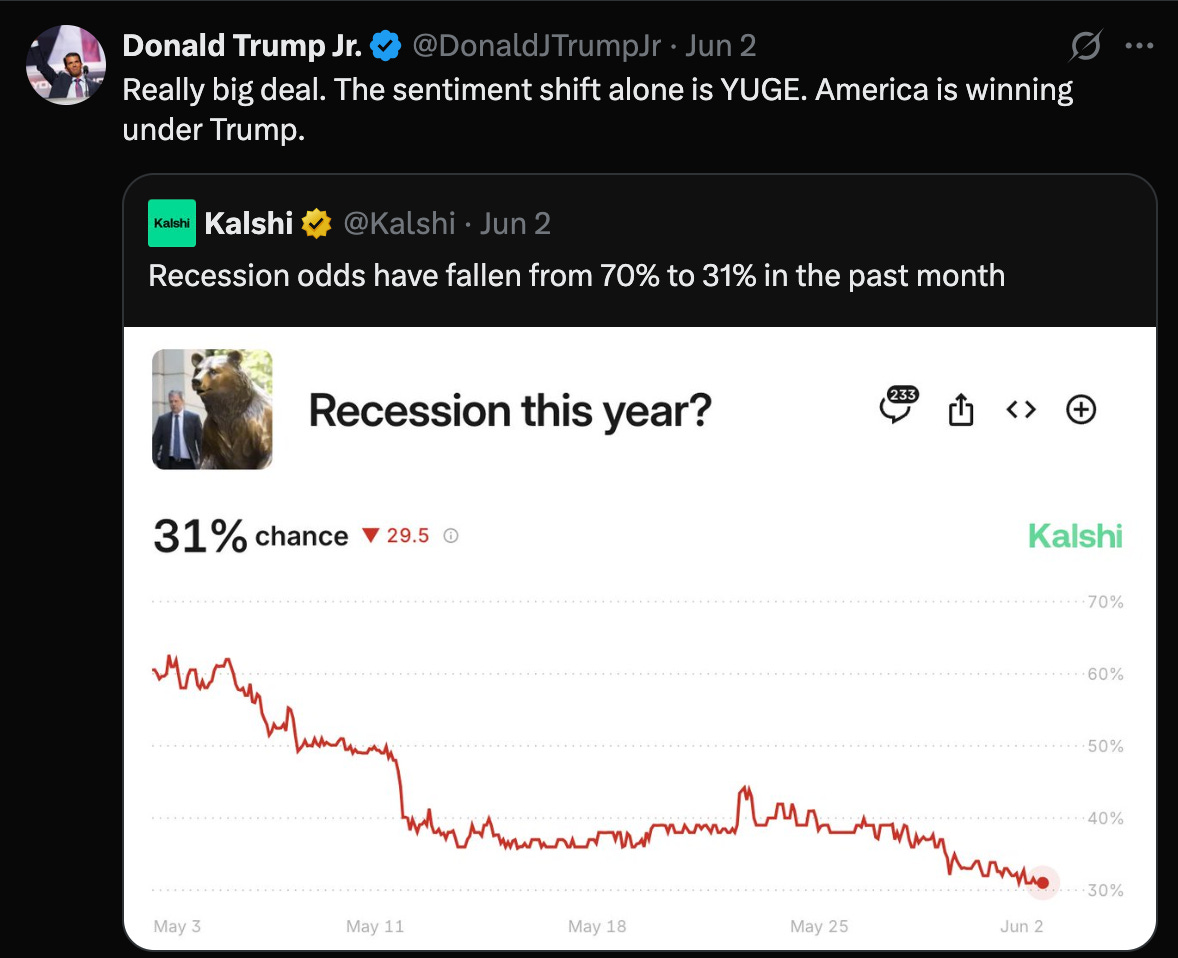

One last related note: Kalshi advisor Donald Trump Jr. posted on Twitter this week that recession odds have dropped significantly at Kalshi. This is, of course, pretty funny because they were lower before his father plunged the economy into a great deal of uncertainty over tariffs:

Trump’s CFTC pick gets hearing next week (Event Horizon): “The US Senate is finally starting the process of installing a new chair for the Commodity Futures Trading Commission. The confirmation hearing for Brian Quintenz, President Donald Trump’s nominee for the CFTC chairmanship, will take place on June 10 at 3 pm Eastern in the Senate Committee on Agriculture, Nutrition, and Forestry.”

This could be a pretty big moment — in theory — for prediction markets. We might hear for the first time what Quintenz intends to do around the nascent industry, either through prepared statements or questioning. If we don’t hear much, that would be pretty disappointing, given the import of the topic and the relative lack of communication from the CFTC in recent months.

Can the CFTC function normally/at all with just one commissioner (ie the chairman)? We’re probably going to find out for some amount of time. Interesting post from Dorothy DeWitt, former CFTC Director of Division of Market Oversight, on LinkedIn:

There is uncertainty around the CFTC unitary Chairman theory, namely whether nominated CFTC Chair Brian Quintenz could perform "all" functions of the CFTC as the sole Commissioner and Chair while the remaining four Commissioner seats are empty in light of the departure announcements. I'm doubtful. While it is true that Section 2(a)(3) of the CEA provides that "a vacancy in the Commission shall not impair the rights of the remaining Commissioners to exercise all the powers of the Commission," I note that the CEA provides "a vacancy" (not multiple, let alone four), and employs the plural "remaining Commissioners" (not "remaining Commissioner(s)”). In addition, CFTC Rule 140.11 allows a single Commissioner to act on behalf of the Commission in all functions except rulemaking in emergencies, and references a quorum requirement for non-emergency Commission action.

Even if Brian Quintenz could, I doubt he'd want to be the sole Commissioner. First, doing so puts the Commission at litigation risk for lack of authority. Second, he will recuse on certain conflicting matters (Kalshi, etc.) that will indubitably come before the Commission, and things will get messy. Finally, the Chair benefits from having a full slate of five Commissioners. Each Commissioner chairs a critical CFTC committees, provides expertise and feedback on policy and rulemaking (improving policy and outcomes), and faces off to Congress, other regulators, industry, and market participants. A unitary Commissioner structure undermines the wisdom and effectiveness of Commission's decisions, to the detriment of all.

A unitary Commissioner may, however, have the authority to approve designations, something that has not been discussed in recent analyses. That is one to watch carefully, especially in prediction markets.

Schwab monitors prediction markets as Kalshi targets brokerages (Investment News): “Financial services giant Charles Schwab Corp. is closely following the regulatory landscape of prediction markets, as leading exchange Kalshi targets integrations with financial brokerages. ‘We’re monitoring the space and regulatory landscape closely, but we don’t have any plans at this time,’ a Charles Schwab Corp. spokesperson said in an emailed statement to InvestmentNews. Charles R. Schwab, the company’s founder and co-chairman, invested in Kalshi’s $30 million Series A in a 2021 funding round that also included KKR co-founder Henry Kravis. Charles Schwab’s granddaughter, Samantha Schwab, worked as a business development executive at Kalshi before President Donald Trump appointed her in January to be deputy chief of staff for the US Department of the Treasury.”

When It Comes To Week 1 NFL Moneylines, Kalshi Doesn’t Stack Up (InGame): “If you’re looking to bet NFL Week 1 moneylines right now, I’ve got news for you: Stay away from Kalshi. Yes, Kalshi made a minor splash in the sports gambling — sorry, prediction market — world last week when it posted its Week 1 NFL action, but a quick look at the odds its offering, compared to odds at traditional regulated sportsbooks, shows a discrepancy big enough for Derrick Henry to run through — at least for the moment. For starters, let’s look at the opening-night game, where the Super Bowl champion Philadelphia Eagles play host to the Dallas Cowboys. Right now, you can get the Cowboys for +270 at ESPN Bet, or you can buy a contract on Dallas at Kalshi for 27 cents. Some quick odds calculator math shows the difference. A $100 bet on the ‘Boys pays out $370 at ESPN BET, while $100 in contracts at Kalshi would pay out $352. … Of course, all of the above comes with a few caveats. For starters, we are very early in the game, pun intended. Odds for these games are going to change in the [checks notes] three months until kickoff, and they might very well tip in Kalshi’s favor.”

Odds and ends:

Mansour posted that you could “put $2-3m on your team” in the Champions League because of Kalshi’s stellar liquidity. Sounds like great responsible gaming. (Truth be told regulated sportsbooks like to market giant bets too, but at least they don’t pretend it’s not gambling.)

I’ve covered this a bit at both newsletters, but here’s ESPN’s piece on Kalshi and prediction markets, with quotes from me: “There's no doubt that it's gambling. You can argue on the logistics, and whether it's federally legal, all of that. But it's gambling."

I haven’t heard anything new from Kalshi on their investigation into the California gubernatorial candidate who bet on himself. If you’re playing catch-up, here’s the backstory. You can see the market here, where the Republican at the center of the brouhaha is still a pretty big longshot.

Ridiculous things you can

bettrade on at prediction markets, Elon vs. Trump edition:Polymarket: “Will Trump jail Elon Musk?”

Kalshi: “Will United States ban X?” Obviously actual economic consequences here, but c’mon.

Both: Kalshi and Polymarket have versions of “will Elon unfollow Trump” on X/Twitter. Think of the economic consequences* of this market! (*I can’t think of any).

Other things I published this week on prediction markets

More Times Kalshi Said You Could Bet On Things: An Update

Kalshi shies away from betting language more than it did even a few months ago. But its CEO and marketing/social media teams still find a way to refer to Kalshi as a betting product on a semi-regular basis.

Think Tank To CFTC: 'Adopt A Policy Of Permissionless Innovation' For Prediction Markets

A conservative think tank penned a letter to the Commodity Futures Trading Commission advocating for “a policy of permissionless innovation toward prediction market venues.”

Kalshi Dominated By Sports Betting Again Last Week

Kalshi continues to be largely a platform for sports betting, with more than 80% of all trading again involving sports event contracts for the past week.