The News Cycle For Kalshi Is Relentless

A Robinhood-Kalshi partnership for the Super Bowl came and went in 24 hours, as the future of sports betting across 50 states hangs in the balance

The Event Horizon is a weekly newsletter from gambling industry consultant and analyst Dustin Gouker on the prediction markets industry. He runs a daily newsletter on the online gambling industry called The Closing Line.

It feels like the prediction markets industry has been through several lifetimes worth of news since the first edition of this newsletter; let’s get everyone up to speed:

On Friday, The New York Times (paywall) reported that Kalshi would be working to get its markets listed with brokerages.

On Monday, Robinhood launched Super Bowl contracts in a partnership with Kalshi. (The original press release has since been nerfed.) Kalshi recently started allowing trades on a small number of sports markets in all 50 states, including the Super Bowl.

The same day, Bloomberg (paywall) reported that the CFTC put sports contracts under a special review to determine if they are gaming. (Spoiler alert, they definitely are, it’s just a matter of whether they meet the regulatory definition. To wit, Kalshi even rolled out the ability to look at the markets via American odds, which are the parlance of sportsbooks. It even has “Bet on the headlines” right in its tagline in the App Store.)

About 24 hours later, Robinhood took the Super Bowl market down after receiving a request from the Commodity Futures Trading Commission.

The American Gaming Association issued a statement decrying the sports event contracts as gambling. In part: “The proceedings at the CFTC prompted by current efforts raise important questions, and the AGA further urges these companies to cease offering sports event contracts during the CFTC’s review period. Failure to sustain and uphold state regulatory frameworks on sports wagering poses potential consumer risks and jeopardizes state revenues dedicated towards critical priorities, such as public education, infrastructure projects, and responsible gaming programs and problem gambling services.”

On Wednesday, acting CFTC Chair Caroline Pham sounded a positive note for prediction markets writ large alongside a roundtable announcement. “Unfortunately, the undue delay and anti-innovation policies of the past several years have severely restricted the CFTC’s ability to pivot to common-sense regulation of prediction markets,” she said. More detail below.

In the middle of all of this, Kalshi expanded its sports markets to include a handful of new tennis, soccer and esports markets.

Whew, that’s a lot. As a side note, I’ll likely start putting out short news blasts via this newsletter as events warrant, given how much happened just this past week.

So here are the central questions that we’re all grappling with right now:

Will sports contracts as they launched at Crypto.com and Kalshi be allowed to continue?

And if they are allowed to continue, how far will they be allowed to expand (all sports, individual games, player props, etc.)?

These are two pretty massive uncertainties, and unless you are privy to the thought process of decision-makers at the CFTC, it’s difficult to know the answer. Here are the three top-level outcomes, as I see it:

If sports contracts are allowed to continue and the types of markets expand to a much more granular level, we’re looking at a seismic shift in sports betting in America. The ability to offer sports betting markets in every state changes the game and will likely result in many more entrants into the prediction markets space.

If sports markets are allowed to continue but in a fairly limited manner, we’ll be off of Defcon 1 for the future of US sports betting. It would be an interesting product, but if it’s just for long-term futures of different leagues and sports, that’s a much smaller opportunity. However, it would still be worth exploring.

If the CFTC (or some other mechanism, ie state-level pushback) bans sports event trading, Kalshi and other prediction markets will still have a nice business, just with a considerably lower ceiling.

Which one are you betting on happening? Again, we’re reading a lot of tea leaves right now. President Donald Trump and many of those around him seem to be enamored with prediction markets in general and Kalshi and election markets in particular. Donald Trump Jr. is an advisor to Kalshi. We ingest the above and it’s easy to feel like the answer is already baked into the cake; it’s tempting to surmise that Kalshi is going to get to do what it wants.

But the CFTC under Trump is at least pumping the brakes. The Bloomberg report makes it seem like the CFTC is still reviewing things seriously; the request to Robinhood to pull down Super Bowl markets adds to that narrative. The AGA piling on underlines that this is just quasi-regulated sports gambling; is even a friendly CFTC ready to let that happen?

We may get more data on all of that at an upcoming CFTC roundtable announced this week:

“The Commodity Futures Trading Commission will hold a public roundtable in approximately 45 days at the conclusion of its requests for information on certain sports-related event contracts. The goal of the roundtable is to develop a robust administrative record with studies, data, expert reports, and public input from a wide variety of stakeholder groups to inform the Commission’s approach to regulation and oversight of prediction markets, including sports-related event contracts.”

“Unfortunately, the undue delay and anti-innovation policies of the past several years have severely restricted the CFTC’s ability to pivot to common-sense regulation of prediction markets,” said Acting Chairman Caroline D. Pham. “Despite my repeated dissents and other objections since 2022, the current Commission interpretations regarding event contracts are a sinkhole of legal uncertainty and an inappropriate constraint on the new Administration. Prediction markets are an important new frontier in harnessing the power of markets to assess sentiment to determine probabilities that can bring truth to the Information Age. The CFTC must break with its past hostility to innovation and take a forward-looking approach to the possibilities of the future.

The release also noted these “key obstacles” to be addressed related to sports contracts:

“CFTC-registered entities’ legal arguments in court that event contracts based on games or sports contests or sporting events constitute ‘gaming’ and are therefore prohibited under the Commodity Exchange Act.

“…other issues including but not limited to Constitutional questions such as the Commerce Clause, States’ rights and State regulatory schemes, Federalism, Federal preemption doctrines, and Tribal sovereignty as well as other federal laws applicable to sports betting.”

More background and reporting on everything going on with prediction markets from Sportico here.

We live in interesting times. I am fascinated to see what will happen next.

The Closing Bell

A roundup of prediction market industry news; I covered most of it above, but here are a few more nuggets:

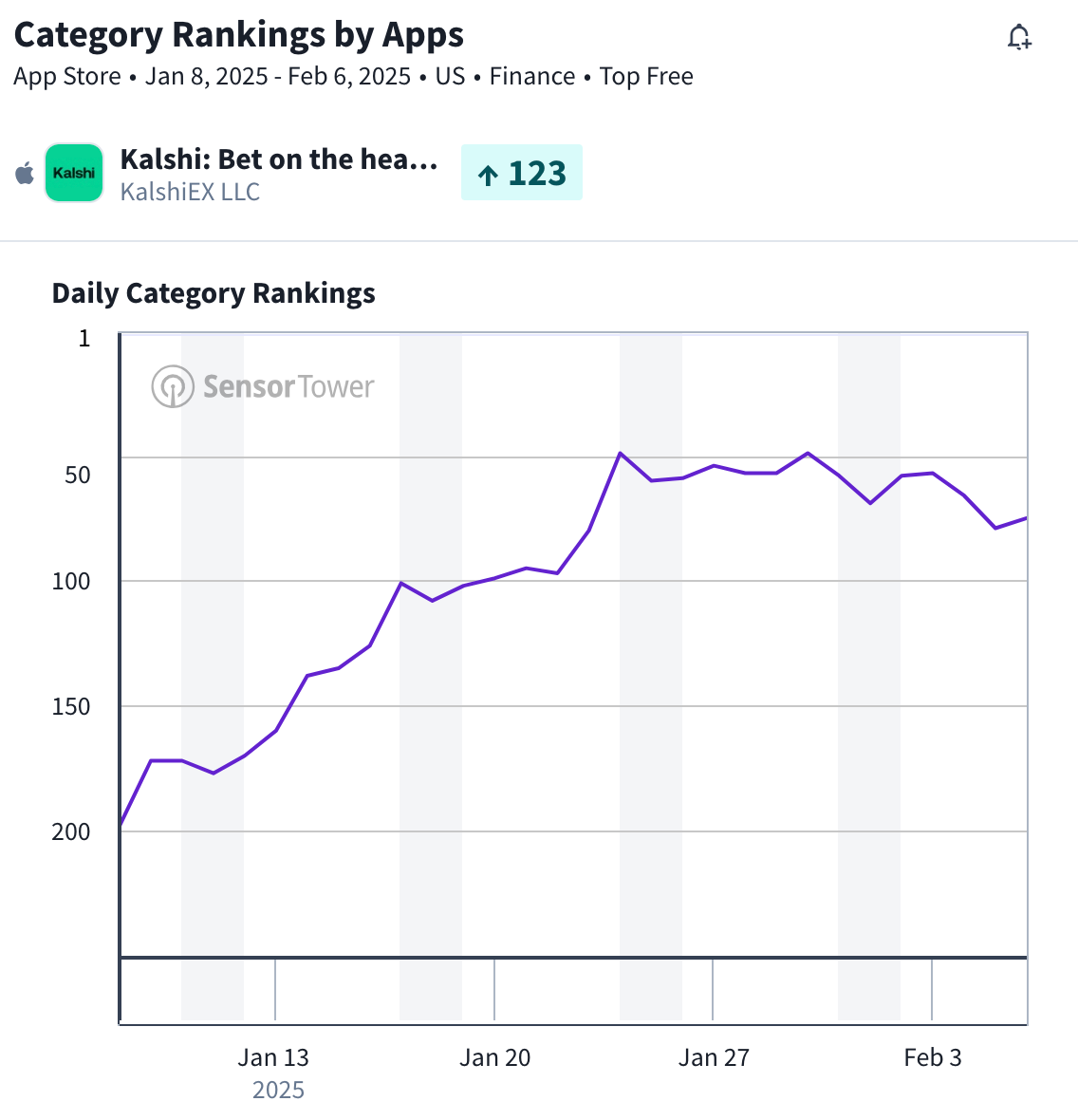

Kalshi improves rank in App Store, but sports hasn’t moved the needle that much?: It’s interesting to look at how Kalshi is performing in the App Store in the past month. It’s improved greatly among free finance apps — albeit well off the high of being No. 1 for all apps leading up to the November elections. But it’s not clear that the launch of sports contracts has moved the needle that much. The day after sports markets launched, Kalshi jumped from 80 to 49; since then its position has dropped back to 75, despite the upcoming Super Bowl. (Data from Sensor Tower.) It paints a picture that customer acquisition for Kalshi has not been massive around the opportunity to bet on the Super Bowl in all 50 states, at least so far. That’s certainly something that Kalshi will work on should it continue trying to grow its sports business.

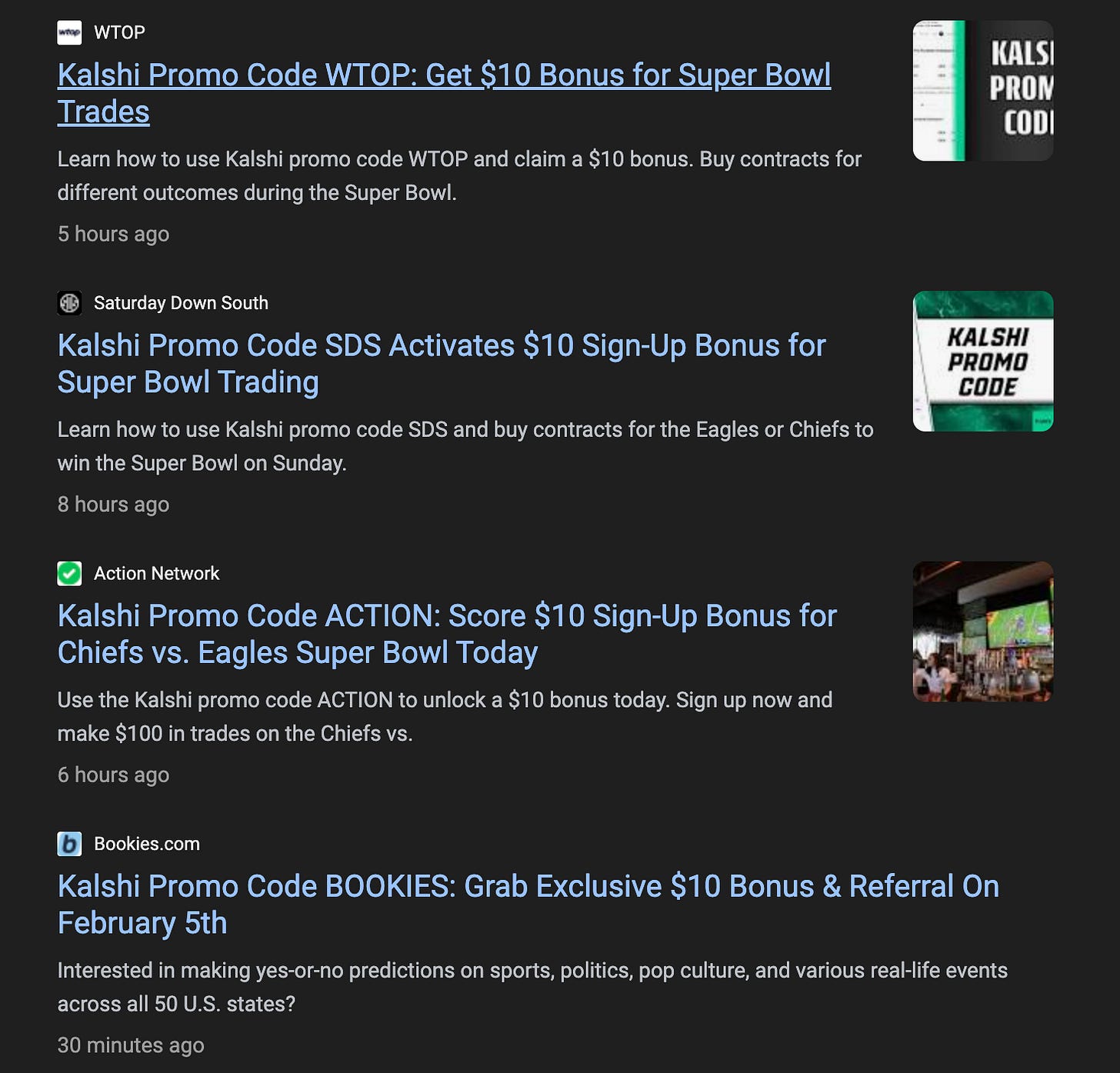

Related to the above on customer acquisition, there is no shortage of affiliates trying to send leads to Kalshi, from looking at the news feed:

Kalshi CEO touts Elon Musk’s interest (LinkedIn): Here’s Tarek Mansour: “Elon Musk is increasingly turning to Kalshi’s forecasts, especially to track DOGE’s progress. The US government is starting to use Kalshi to inform policy.”

That’s reading a lot into a Musk tweet that said “interesting,” but you would of course rather have the world’s richest man noticing your business than not. There is only $700,000 traded on the market in question, so count me as skeptical how useful Kalshi is on this particular front.

Trade Winds

A quick look around at interesting trends and markets at Kalshi (and beyond):

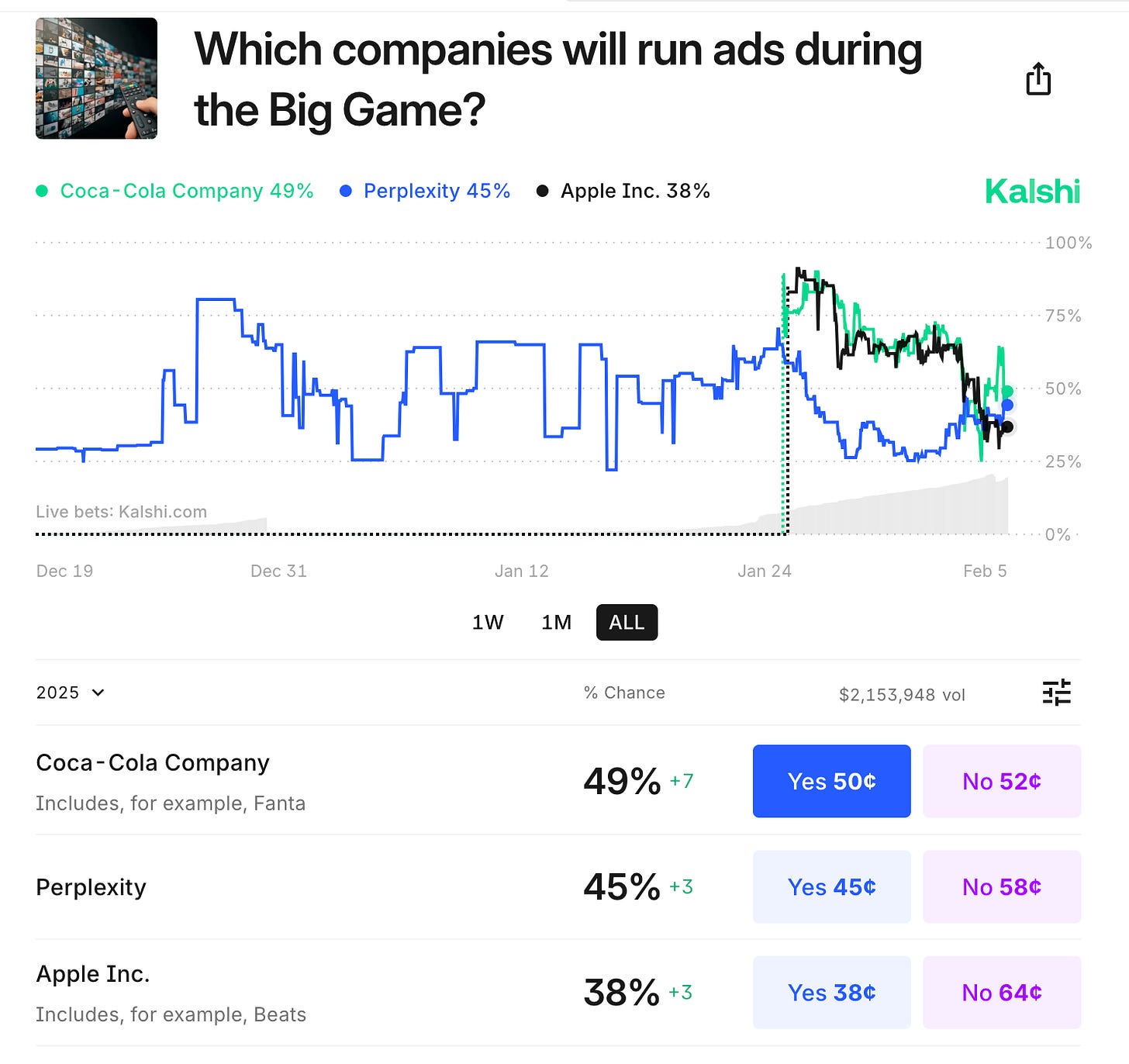

Super Bowl ads trading vs. trading on the game: There has been about $3 million traded on the outcome of the Super Bowl between the Kansas City Chiefs and the Philadelphia Eagles. But not far behind is the market for which companies will have ads during the Big Game, at $2.1 million. With some companies not announcing or previewing a commercial, there’s a bit of intrigue here:

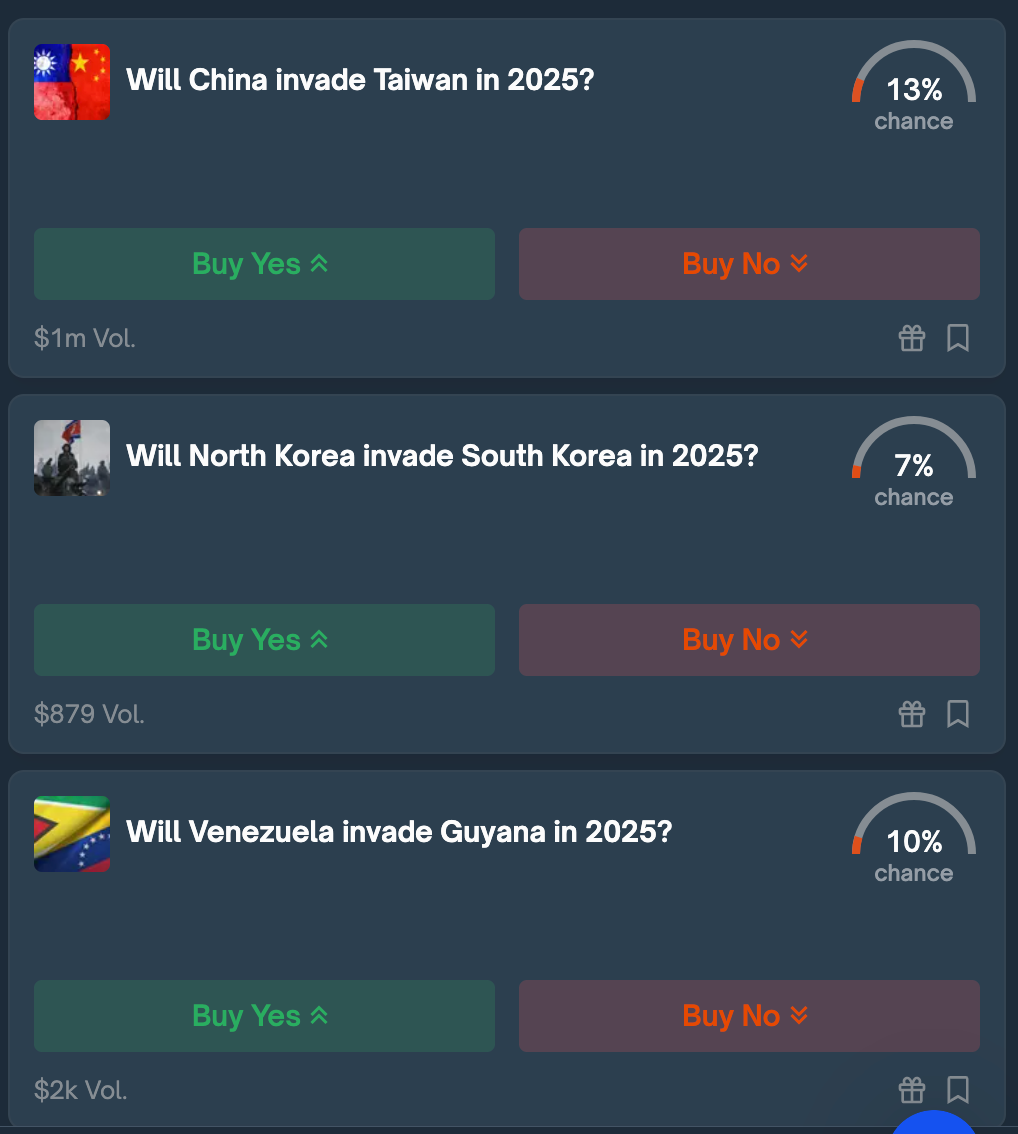

There are three “invasion” markets on Polymarket: How tasteful it is to let people bet on/trade on invasions is fair to question, and two of these markets are de minimis. There has been a million traded on China invading Taiwan:

A penny for your thoughts: You can trade on whether the US will get rid of the penny before 2027, although there’s very little volume so far. (Dare I say, pennies.) I will say it does seem silly to keep making pennies.

Thanks for sharing the links about affiliate activity in the prediction space. I'd been looking for that pre Christmas / pre sport event markets launching and didn't see any so it is good to see these. Interesting that Gambling.com, Better Collective and Sportsradar owned affiliates are all there. Will be interesting to see what if anything they say about prediction markets in their Q4 trading updates in the coming weeks.