How Much Money Is Being Traded On The Super Bowl at Kalshi?

Sports trading in general is off to a bit of a slow start at the prediction market platform

Event Horizon is a weekly newsletter from gambling industry consultant and analyst Dustin Gouker on the prediction markets industry. He runs a daily newsletter on the online gambling industry called The Closing Line.

If you didn’t know it, now you do: you can trade on the outcome of the Super Bowl at Kalshi as of last week.

Beyond being a marketplace for trading on politics, entertainment and the weather, Kalshi is now also a sportsbook sports trading platform available in 50 states. So far, the platform is sticking to true “futures” bets, such as who will win the NBA title or the Stanley Cup. (Crypto.com also launched similar markets in December.)

But Kalshi’s biggest market in its first week was professional football. You can trade positions on the Super Bowl between the Kansas City Chiefs and Philadelphia Eagles right now. About $1.7 million has been traded on The Big Game in the first week.

Here’s what we learned from the first weekend of sports trading at Kalshi:

In-game/live trading generates way more volume than pre-match futures. And it’s not even close. I believe there was less than half a million dollars traded on each game before kickoff. But the total amount traded across both games ended up being about $4 million. In the graph below, you can see how much more trading took place on the AFC title game once it started (see the activity graph in gray at the bottom):

Given access in 50 states and an existing user base, the trading volume seems low. It is a bit early to declare anything, but I think I and others probably expected more action. In fairness, the launch was midweek, although it did come with a ton of earned media. A single mid-sized sportsbook in a median population state likely took $4 million in bets on Sunday’s NFL games. The Super Bowl — especially in-game trading — will likely be a better litmus test for the rollout at Kalshi. There will be two-plus weeks for users to discover it, and for Kalshi to do some customer acquisition around it. For what it’s worth, one projection puts $1.5 billion in wagers at regulated sportsbooks for the Super Bowl. That doesn’t include black and gray market wagering on the game, on top of the casual gambling that will take place across the country.

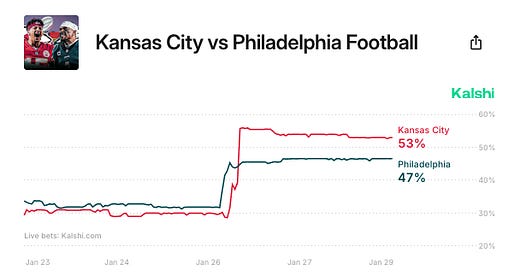

There isn’t a ton of divergence from sportsbook odds for the Super Bowl, at least. The Chiefs are a small favorite for the Super Bowl, just like at traditional sportsbooks, at about a 53% chance of winning. FanDuel, for instance, has the Chiefs as a -124 favorite on the moneyline, which equates to about a 53% chance as well.

You can trade on some of the novelty Super Bowl markets: While not technically “sports,” there are a trio of markets available that are related to the Big Game:

Which companies will run Super Bowl ads? About a million dollars has been traded. Coca-Cola is the most likely to have an ad of the available markets by company.

What songs will be played at the Super Bowl? All The Stars is the favorite for inclusion; Not Like Us is at 92% and I have to say it would be extremely funny if it is.

Who will be a part of Kendrick's Super Bowl half-time show? SZA has a 98% chance of appearing, per this market, and there are no available contracts. Since the NFL has put on NFL.com that SZA is appearing, that’s not likely to change.

It will be interesting to see if they get into some of the markets that are really popular with bettors, either via regulated or offshore sportsbooks. The length of the national anthem and the color of the Gatorade bath for the coach of the winning team are big ones. I am actually surprised these aren’t up yet.

Other sports aren’t very popular, yet: All other sports markets on Kalshi have generated well south of a million dollars in activity in sum, with the NBA and men’s college basketball champions clocking in as the most popular markets. There has been little interest in trading on the NBA conference champions and the Stanley Cup winner. The World Series winner in Major League Baseball is not yet offered as a market.

There are listed prohibitions on who is not supposed to trade on sporting events. It’s not clear how Kalshi might be enforcing it, if at all, but it does say these people should not be involved:

The following are prohibited from trading this contract:

Current and former players, coaches, and staff of the National Football League, the National Hockey League, National Basketball Association, and the National Collegiate Athletic Association

Paid employees of the league and league participants

Owners of teams and the league

and household members and immediate family of all above

Kalshi is avoiding using league and team names and marks. Right now, terms like “Pro basketball champion” and “Kansas City vs. Philadelphia football” are being used, eschewing NBA and NFL and Super Bowl. At launch, Kalshi was using stock images of sports alongside official team mascots and logos. For football, at least, the stock images are replaced with Photoshopped images of quarterbacks Patrick Mahomes and Jalen Hurts. The team mascots and logos are also gone for all sports, likely because of legal concerns for using marks without approval.

More on the AFC and NFC title games

Here’s the trading history for the AFC title game between the Chiefs and the Buffalo Bills. The Bills were an in-game favorite according to the market for a short period during the game. About $2.4 million was traded on the game.

And here’s the NFC title game between the Eagles and the Washington Commanders. There was considerably less interest in trading this game, at just $1.6 million. Even when the Commanders had a small early lead, they still never became the favorite, according to the Kalshi market:

The Closing Bell

A roundup of prediction market industry news:

Acting Chairman Pham to Launch Public Roundtables on Innovation and Market Structure (CFTC press release): Commodity Futures Trading Commission Acting Chairman Caroline Pham: “As I have long said, the CFTC must take a forward-looking approach to shifts in market structure to ensure our markets remain vibrant and resilient while protecting all participants,” Pham said. “Innovation and new technology has created a renaissance in markets that presents new opportunities that are accessible to more people, as well as risks. The CFTC will get back to basics by hosting staff roundtables that will develop a robust administrative record with studies, data, expert reports, and public input. A holistic approach to evolving market trends will help to establish clear rules of the road and safeguards that will promote U.S. economic growth and American competitiveness.”

Crypto.com Expands Sports Futures Trading Amid Legal Concerns (Sportico): “App and web users are now able to buy and sell derivative contracts that convert into $100 based on the outcome of NFL, NBA and UEFA Champions League seasons. For example, a Kansas City Chiefs championship contract currently costs $57, while Philadelphia Eagles bids cost $49. Traders can adjust or move out of their positions up until the kickoff of the Super Bowl.”

Will the leagues themselves own sports prediction markets? (Casino Reports): The leagues want more control of how sports betting goes down; that was true before and after the repeal of the federal ban in 2018. But how far does that desire go? “If CFTC-regulated sports exchanges become a reality, the sports leagues themselves will swiftly move to operate such exchanges,” predicts Ryan Rodenberg, a professor at Florida State University who has followed the Kalshi-CFTC litigation closely. “By doing so, the leagues will be direct competitors in the space, and will try to put certain sports betting operators out of business.”

Kalshi's approach is regulation and trust upfront, co-founder says (Video, Fox Business)

Trade Winds

A quick look around at interesting trends and markets at Kalshi (and beyond):

A third term for Trump? While Trump being allowed to run for a third term seems pretty unlikely, the Kalshi market puts the chance of this happening at 11%…albeit with only $33,000 traded. That seems like a pretty lofty price given what has to happen: “If the 22nd Amendment is repealed or if the Supreme Court reinterprets the 22nd Amendment to permit an individual to be elected President more than twice before Jan 1, 2029, then the market resolves to Yes.”

Eggs-actly: A big theme of the 2024 elections was inflation and the price of groceries. The price of eggs, in particular, seems to create a lot of consternation in the US population, as a dozen eggs is nowhere near as cheap as it once was. Enter a prediction market: Will egg prices go up in Trump's first month in office? There’s a relatively low trading volume (about $150K), but the market puts it at an 80% chance of being higher. Bird flu has been contributing to the rising price of eggs, even outside of any inflationary pressure.

It might help if you’re a meteorologist…: If you’re new to prediction markets, or you only know about them because of the election, you’ve only hit the tip of the iceberg. One of the most popular markets to trade on Kalshi is the weather in New York City. More than $30 million has been traded on the high temperature in the Big Apple over time. Tens of millions has been traded on the weather in other major US cities as well.

About this newsletter

If you’re one of the people reading the first edition of this newsletter: Thank you! What you see above is the starting vision for Event Horizon. It will begin with One Big Thing — a deep dive into something in the prediction markets industry — then move into some nuggets about the markets and industry news. If that’s something that interests you, I hope you’ll subscribe. There are no plans to put any of the content into a paid tier.

Does the world need a newsletter just about prediction markets? Maybe, maybe not. But when the lid came off of event trading for sports at Kalshi last week, it felt like the right time to start something. I was writing quite a bit about prediction markets already at my gambling newsletter. And it feels like there is room (maybe even a need?) for a newsletter like this for people who want to keep up with the goings-on of this nascent industry.

I started covering the daily fantasy sports industry just over a decade ago, in January 2015. I came into it not knowing very much about DraftKings, FanDuel and the DFS industry, which would set the stage for legal sports betting. Eventually, I’d become one of the most trusted sources covering all of it.

As we sit here in January of 2025, what’s going on in prediction markets feels eerily similar to what was happening in daily fantasy back then:

There are a couple of big players (Kalshi in the US, Polymarket abroad).

There is undoubtedly about to be a land rush to create more prediction markets platforms serving the US.

The future on the legal front is a bit murky.

There’s not enough dedicated analysis coverage just of this industry.

So that’s where I come in. I am starting this as a weekly newsletter, and we’ll see where it takes me. Val Cross, whom I worked with in a past life, has agreed to help me build this newsletter, and you’ll see her words here too eventually.

So I hope you’ll take the journey with us.

Thanks for getting this going, Dustin. Very interested to see where things go with prediction markets in general and especially on the sports betting side. The Ryan Rodenberg piece on pro leagues running their own prediction markets is very interesting. Is this possible?