The Closing Bell: You Can Bet On The Nathan's Hot Dog Eating Contest At Kalshi

Roundup: DraftKings 'circumspect' about prediction markets; the latest on Polymarket-X deal; a new prediction market called Railbird is coming; all of the amicus briefs filed in Kalshi vs. NJ.

The Closing Bell is a roundup of prediction market news, analysis, and other thoughts each Friday.

Want to bet on Nathan's Famous International Hot Dog Eating Contest anywhere in the United States? You’re in luck.

Kalshi launched a couple of markets on the contest: 1. who will win and 2. how many hot dogs the winner will eat.

The best competitive eater in the world — Joey Chestnut — is returning to the contest after a one-year hiatus.

While tentpole events can often do well for Kalshi, it’s not clear this will be one of them. Kalshi is primarily a vehicle for live trading, and there won’t be a huge opportunity on that front for a couple of reasons:

Chestnut is a huge favorite; the last time he lost the contest was in 2015. Chestnut has a 92% chance to win at Kalshi, albeit with only $4,000 traded.

The live-trading opportunity is also relatively muted. The contest is only ten minutes long; the longer the time horizon of an event, the better the live-trading potential for Kalshi. We would also likely have to see Chestnut pull out or struggle in order for people to trade a lot during the contest. While that’s possible, it’s unlikely based on Chestnut’s track record. Blowouts = bad for Kalshi trading.

While we can easily come up with economic consequences for the winners and losers of the contest, it’s a lot harder to imagine an economic consequence based on the number of hot dogs eaten by the winner:

I’d be happy to hear why these are legitimate hedging opportunities — if you can come up with one — or the value of the probabilities and “price discovery” around this market. It’s just gambling… which would be fine if we could just call it that and it was treated as such.

A few final thoughts on this:

You can bet on the contest in some states via regulated sportsbooks, but some state regulators prohibit it.

I’ll be curious if Robinhood offers this market; it’s not yet listed on their app.

Sports are most of Kalshi’s business, but the sports calendar starts getting thinner in the summer months with the end of basketball and hockey. There’s Major League Baseball, soccer, golf, and tennis. Otherwise, it’s safe to bet that Kalshi will keep trying to find avenues in and out of sports to drive trading until football season rolls around.

The roundup

The big news of the week was all of the amicus briefs that were filed in support of New Jersey in its federal court case against Kalshi. I wrote about the briefs filed with the Third Circuit Court of Appeals and included most of the briefs at my other newsletter, The Closing Line:

The headliners among the briefs are 34 states and hundreds of tribes joining together to fight Kalshi, asserting that it is offering illegal sports betting.

The New Finance Institute also entered a brief a little after the deadline. You can see it below. NFI doesn’t argue on behalf of either party but does advocate for the reversal of the preliminary injunction in district court:

More coverage of the amicus briefs:

What you need to know about these Kalshi legal briefs (SBC Americas)… this is a good roundup of all of the amicus briefs.

Tribes: Kalshi ‘Tramples’ On Sovereignty, Exclusivity (InGame)

Casino Association of New Jersey Files Amicus Brief in Prediction Markets Case (PlayNJ)

I recorded a short podcast about the states’ amicus brief:

DraftKings ‘Circumspect’ on Prediction Markets, Says Analyst (Casino.org): “Amid increasing fervor regarding the competitive threat posed by prediction markets to sportsbook operators, DraftKings (NASDAQ: DKNG) appears to be among the gaming companies that won’t rush into the yes/no derivatives arena. At the Jefferies 2025 Consumer Conference in New York, analyst David Katz met with DraftKings management, coming away with the view that operator isn’t planning to accelerate a possible prediction markets entry over the near-term. ‘DKNG indicated it would be circumspect about the exploration of prediction markets,’ wrote the analyst in a note to clients.’ … Katz noted it’s possible gaming companies are already having internal conversations regarding how they can bolster defenses against prediction markets. ‘The discussions also focused on the permutations for prediction markets, which appear to be gaining scale with little regulatory headwind, causing operators to determine whether to offer the product on an unregulated basis. Our sense is that buy vs. build explorations are underway for,’ added the Jefferies analyst.”

FanDuel, Kalshi Have Discussed a Deal (Front Office): This is definitely news, but the amount of news in here is pretty minimal. The headline is the extent of the new information — the rest is backstory, context and speculation — and the source of the information isn’t named. I would probably have been more shocked to learn that FanDuel hadn’t talked to Kalshi.

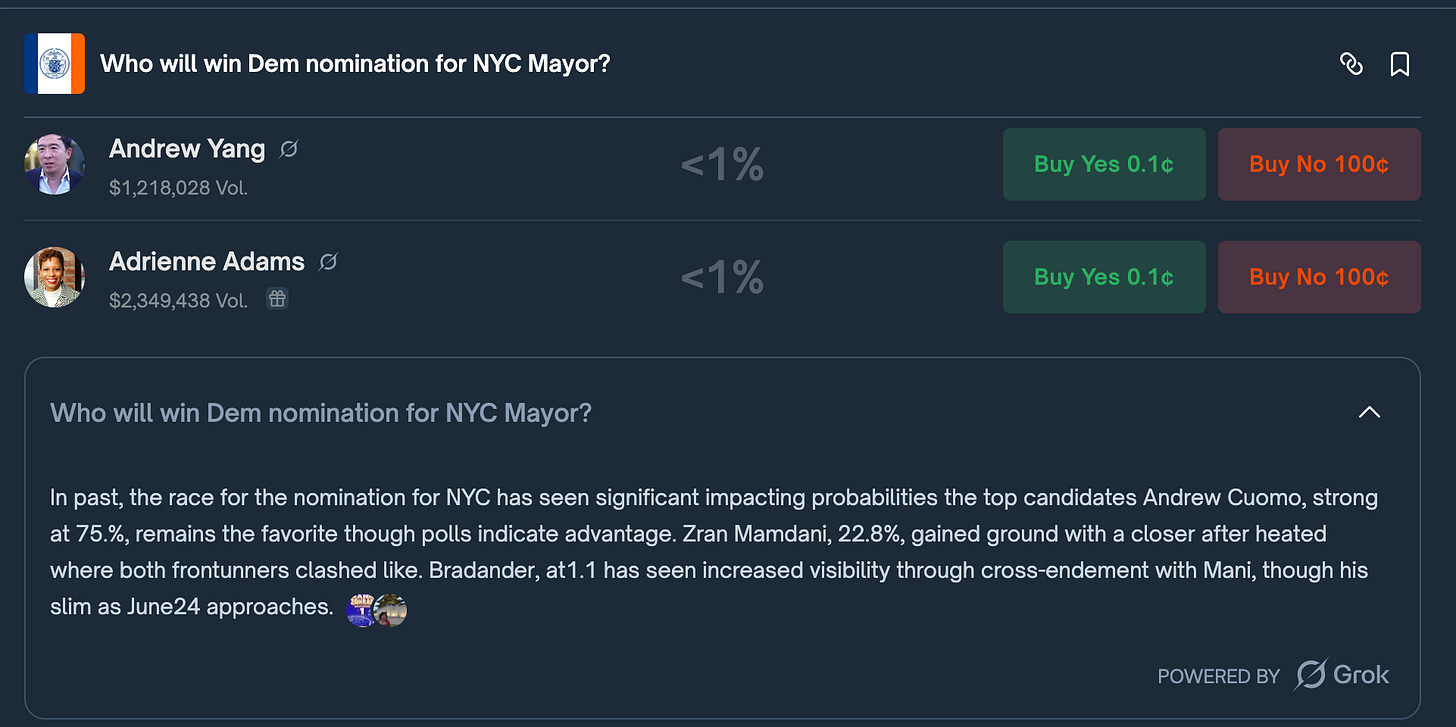

Update on the Polymarket-X deal: We haven’t seen the full extent of the integration of the prediction market platform and the social media giant. But you can now get market insights from Grok directly on Polymarket. For example:

Based on the grammar, syntax and quality of content, it seems like this has a way to go, as these are pretty terrible.

I am not finding much evidence of Polymarket being integrated into X. I asked Grok about it, and here’s what it told me: “Currently, there’s no specific section or dedicated page on X’s platform (web or mobile app) explicitly labeled as a “Polymarket integration” where users can directly view or interact with Polymarket’s prediction markets. Instead, the integration appears to be more visible on Polymarket’s side, where X posts and Grok annotations are embedded to enhance market context. On X, you may encounter Polymarket-related content indirectly through posts or trends discussing prediction markets, especially around high-profile events like elections or sports, but native betting or market data isn’t yet embedded in X posts or feeds based on available information.”

Enter Railbird: A new designated contract market, Railbird, recently got approval from the Commodity Futures Trading Commission. You can see all the docs and approval here.

From Linkedin: “Excited to announce that Railbird has received its Designated Contract Market status from the CFTC! This milestone makes us one of the few companies legally allowed to offer a prediction market in the United States. Stay tuned for our launch by following us on this page.”

And from co-founder Miles Saffran: “Very excited to announce that, after a long review, Railbird is officially a CFTC-approved Designated Contract Market (DCM)!

A DCM license allows us to operate a regulated futures exchange in the U.S. In our case, we’re creating a market for event contracts, where people can trade on the outcomes of real-world questions.

There are a small number of DCMs in the country, most of them run by large institutions like CME and CBOE. We’re proud to be joining that list. …

In many ways, this is Day 1 for Railbird and it couldn’t be coming at a better time – prediction markets have experienced meteoric growth in the past few months, producing reliable, real-time information that helps individuals and businesses. Please check us out at railbirdexchange.com, and stay tuned for our launch!”The $64,000 question is of course if Railbird is going to get into sports. Given that not all prediction markets have followed Kalshi and Crypto.com into sports event trading, it’s perhaps not a foregone conclusion. But it’s also hard to believe a new DCM would just pass on the opportunity based on the metrics at Kalshi. There is no mention of sports that I can find on the placeholder site.

More on Railbird here as well.

Upstart prediction market leader has invaded sports betting. Here’s why it matters to Nevada (Las Vegas Review-Journal): “Rep. Dina Titus, D-Nev., also is among those hoping the company (Kalshi) won’t get a foothold in gaming. … ‘The Senate must reject Brian Quintenz’s nomination for chairman of the Commodity Futures Trading Commission, Titus said in a statement. ‘His testimony illustrates how dangerous his appointment would be, including how he plans to transform this important agency into a rubber stamp for unregulated, illegal sports betting nationwide. Mr. Quintenz’s conflict of interest as a board member of Kalshi and disregard for agency processes and procedure make it clear that he is the wrong person to lead the CFTC. The agency should be a strong, independent regulator, not a puppet for the president and his family. I thank my colleagues, including Sens. Adam Schiff and Cory Booker, who raised critical concerns during this hearing and urge the full Senate to reject his nomination.’”

More quotes from Titus via an interview on the link as well.

Betting/trading on Iran: The strife involving Iran, Israel and the United States has been the subject of trading mostly at Polymarket but to some extent at Kalshi as well. For instance, markets on a US-Iran nuclear deal are on both platforms; more than $2 million has been traded at Polymarket, about $100,000 at Kalshi. Polymarket also has markets about whether Iran posseses a nuclear weapon, if the US will take military action against Iran and whether a nuclear weapon will be detonated.

Do these things have economic impacts and is it useful to know the probabilities via prediction markets? On the former, definitely. On the latter, I think there’s some question about the value of the information we are getting from them. A good read from the Imperfect Information Substack from Rajiv Sethi below:

“This is a strange new world we are living in, where the likelihood of a coup or military strike can be tracked in real time, with countermeasures responding to and being reflected in market prices. But the horse is out of the barn — there is nothing that can be done in the foreseeable future to prevent the proliferation of crypto-based prediction markets on any event imaginable. We can, however, try to better understand the system rising up around us and the incentives it creates, with feedback loops between subjective beliefs and objective probabilities, and avenues for the powerful and well-connected to leverage information and amass wealth.”

Should we be able to bet on this stuff? Like Sethi writes, we may have no choice in the matter. It is interesting that Kalshi isn’t posting a lot of the more aggressive markets that Polymarket is. Some people could be hedging on these outcomes, but more likely it’s just a lot of people speculating/betting based on real-time information and news.

Kalshi Is Still Marketing Itself as 'Betting' (Event Horizon): “Recent Instagram ads from the prediction markets platform show that it is still not distancing itself from betting terminology. … You can see one of the Instagram ads here, which twice talks about it as betting. An aside: This may be some of the worst acting in the history of acting.”

How Is Kalshi Doing In Customer Acquisition After Going Viral? (Event Horizon): “The prediction market platform has been growing in recent months and got a small bump after a viral commercial, but downloads still trail most established sportsbooks and fantasy sports apps.”

When I checked today, Kalshi was at No. 49 in free finance apps, its highest ranking in recent months.

Odds and ends

It’s not gambling, it’s predicting (Bloomberg, paywall). The headline is tongue in cheek, fwiw.

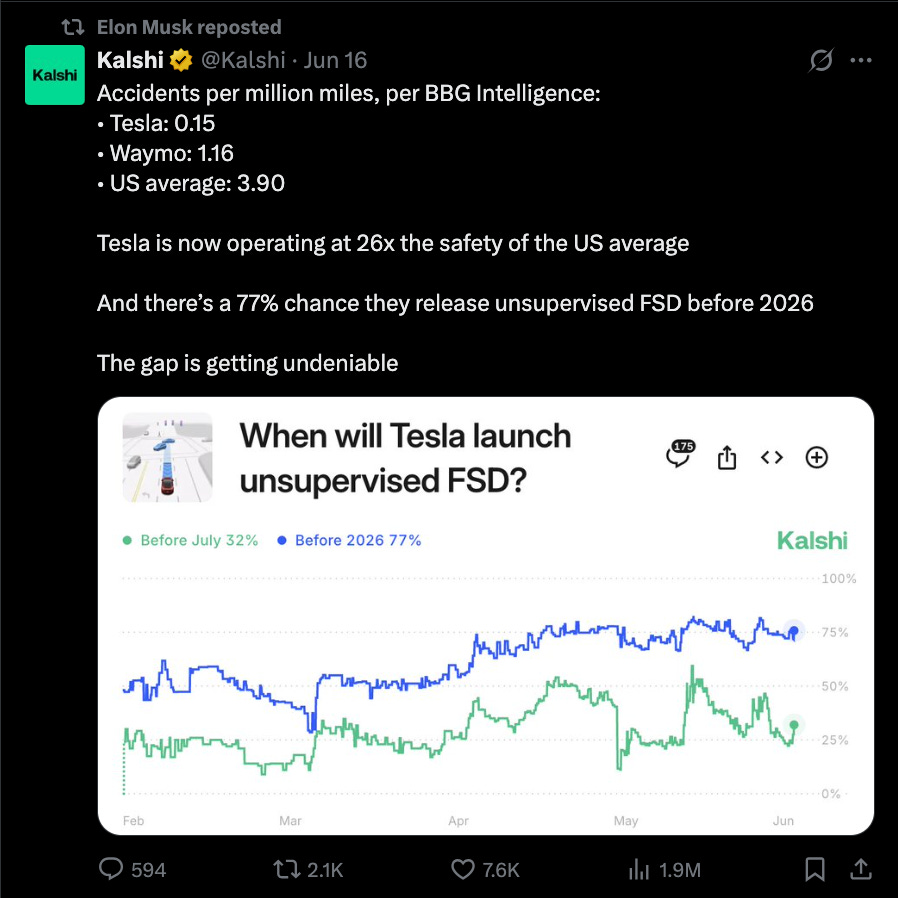

Elon retweets Kalshi: Despite that deal with Polymarket, the owner of X/Twitter still apparently likes Kalshi, too, at least when its markets say something good about one of his companies.

There’s now a Twitter account that tracks large bets made at Kalshi.

Kalshi has a billboard in New York City tracking its market for the next mayor.

Kalshi has merch; example below.

Sports bettor Rufus Peabody learned about maker fees at Kalshi: “I dove into this and found something interesting. For certain big events, @Kalshi is now charging a flat "maker fee" of 0.25% per CONTRACT. I had $1,000 matched at $0.02 (+4900) on Tommy Fleetwood to win. Yet I payed an average of 12.52% fees there, and paid as much as 50% fee on individual contracts I was matched on. How? It's per contract, not per dollar. A contract is to win $1. So if I'm matched on 1 contract of Fleetwood for $0.02, I pay $0.0025 on that. But wait, Kalshi rounds up at the individual trade level. So that rounds to $0.01. So I'm literally paying a 50% fee on that bet that was matched.” Kalshi’s CEO responded as well.

Ridiculous things you can

bettrade on at prediction markets:Polymarket: “Will the US confirm that aliens exist in 2025?”

Kalshi: “Will another GTA VI trailer come out before August?”