The Closing Bell: Will A New Ruling Have A Big Impact On Kalshi Vs. Maryland Court Case?

Roundup: Kalshi hits $2 billion in sports trading volume; DOJ ends Polymarket probe; prediction markets try to capitalize on the viral Astronomer CEO affair.

The Closing Bell is a roundup of prediction market news, analysis, and other thoughts each Friday.

Maryland officials are hoping that a new ruling in a different case will help them stop Kalshi from offering sports betting within the state’s borders.

Maryland has filed the ruling from a US Court of Appeals for the Fourth Circuit case called GenBioPro, Inc. v. Raynes, believing it helps its case in Kalshiex LLC v. Martin et al. Maryland had issued a cease-and-desist to Kalshi for offering illegal sports betting, and Kalshi filed suit in federal court to stop enforcement of that C&D. The case is awaiting a decision from Judge Adam Abelson.

Why is the new ruling potentially germane? Both cases revolve around the same issue of federal laws and agencies preempting state laws — when federal law is potentially not crystal clear and when states have historically been in charge of the issue at hand.

The Fourth Circuit ruled in GenBioPro that the Food and Drug Administration doesn’t usurp a state’s laws, at least in this case. Kalshi’s legal argument in Maryland and a pair of other cases revolves around the Commodity Futures Trading Commission’s ability to preempt state laws around gambling.

How important is the ruling for Maryland’s case? It seems likely to help, but how much it may help is up for debate.

Andrew Kim, a gaming and appellate lawyer at Goodwin Law, offered thoughts to The Event Horizon about the Fourth Circuit ruling’s impact on the Kalshi case:

“There are definitely parts of this that Judge Abelson could cite, if he wanted to hold that the Commodity Exchange Act didn't intend to preempt state gaming and gambling laws. The GenBioPro decision calls attention to an issue to which the judges in Nevada and New Jersey gave short shrift: the presumption against preemption, or the idea that, if Congress is going to push the states out of an area in which they traditionally regulate, it will do so clearly. If Judge Abelson is going to rule against Kalshi, my sense is that he will lean heavily on the presumption against preemption to do so.

You can read more from Kim later in this post on the idea that the Fourth Circuit ruling isn’t a game-changer for Maryland.

Another gaming attorney, Phillip Reale, posted about the potential impact on the Kalshi case on LinkedIn:

“In short, the 4th Circuit clearly upheld the long-standing precedent that Congress does not abrogate state sovereign immunity unless it clearly articulates an intent to do so. This rings especially true in areas of traditional state regulation – such as gaming.

Why is this important? Kalshi has a suit pending in Maryland’s Federal District Court (KalshiEX, LLC v. Martin, Case No. 25-01283) in which Kalshi essentially admitted that its “contracts” on sporting events were “gaming instruments.” Maryland is significant, because it sits firmly within the 4th Circuit, and the district judge will undoubtedly rely on the Genbiopro decision in crafting an opinion.

While Kalshi has several other arguments and this issue is far from resolved, this 4th Circuit opinion should bring a smile to the faces of gaming regulators everywhere.”

And from attorney Daniel Wallach:

“Based on the oral argument alone, Maryland seemed like the strong favorite to end Kalshi’s winning streak in court. Bolstered by the CA4 decision and strong supplemental briefing from the AG’s Office (10/10) + the tribal amici brief which hit all the right notes.”

Credit to Wallach for reporting on the supplemental filing first.

More on the GenBioPro case

The GenBioPro case is about “whether certain federal standards regulating the distribution of the abortion drug mifepristone preempt the West Virginia law as it applies to medication abortions.” From the Fourth Circuit’s ruling:

“The district court determined there was no preemption, and we now do the same. For us to once again federalize the issue of abortion without a clear directive from Congress, right on the heels of Dobbs, would leave us one small step short of defiance. Appellant GenBioPro finds this clear directive in a maze of provisions in the Food and Drug Administration Amendments Act of 2007. It argues that these provisions vested the FDA with the exclusive authority to regulate access to mifepristone. We disagree. In our view, the Act leaves the states free to adopt or diverge from West Virginia’s path. Because the Act falls well short of expressing a clear intention to displace the states’ historic and sovereign right to protect the health and safety of their citizens, we affirm.”

You can see the two filings from Maryland below. The first is a short filing titled “Defendants’ notice of supplemental authority,” which reads:

Defendants hereby give notice of legal authority relevant to this litigation: the Fourth Circuit ruling in the matter GenBioPro, Inc. v. Raynes, No. 23-2194, 2025 WL 1932936 (4th Cir. July 15, 2025) which finds that, “[b]ecause the [Food and Drug Administration Amendments Act] falls well short of expressing a clear intention to displace the states’ historic and sovereign right to protect the health and safety of their citizens,” it did not preempt West Virginia state law.

The second is the court’s finding in the referenced case:

Final thoughts on impacts to Kalshi vs. Maryland

More from Kim:

By no means is the GenBioPro case a silver bullet for Maryland. For one, it's an abortion case, and abortion is a radically different issue. To be sure, gambling, like abortion, "elicit[s] strong objections among people of the utmost good faith." Note, however, that the Fourth Circuit's analysis starts with Dobbs, which telegraphs the heightened (and recent) federalism sensitivities associated with abortion.

And certain aspects of the decision don't apply to the issues teed up in Maryland. The GenBioPro decision talks about upstream-downstream regulation — the fact that the states regulate upstream (whether to permit abortions at all) and the federal government regulates downstream (if abortions are permitted, what kind of medicine may be used). By contrast, in the Maryland case, you have two competing streams of regulation meeting at sports prediction markets: state regulation of gambling versus federal regulation of derivatives markets. Kalshi could easily cite GenBioPro and say, ‘There's preemption where it's the 'natural implication of' the statute, and the natural implication of the CEA's Special Rule clearly leaves it to only the CFTC to regulate even contracts involving gaming.’”

The bottom line is that, if the decision is relevant to Judge Abelson at all, it'll just be used to reinforce a conclusion he's already reached. To me, GenBioPro isn't so persuasive that it swings the case one way or another. I doubt it'll change his mind. But notwithstanding the recent Fourth Circuit decision, Judge Abelson is probably thinking hard about the presumption against preemption, and the fact that (1) the CEA's exclusive jurisdiction is somewhat ambiguous as to its scope, and (2) the Special Rule doesn't really make clear which regulator is in charge.

We could be getting a ruling from Judge Abelson in the Kalshi vs. Maryland case soon. No matter what the decision might be, it will likely be important to the future of sports betting via prediction markets. Either we get a third court agreeing with Kalshi — at least in the early stages — or we get Kalshi’s first loss to the states.

The roundup

Kalshi, the sports betting site/app: If anyone is harboring any illusions that Kalshi isn’t highly dependent on sports betting, you’re living in a different reality than the rest of us.

Kalshi Hits $2B In Sports Trading Volume, But What's That Mean? (The Closing Line): “Sports is the dominant bucket for trading at Kalshi, and it’s not even close. By some tracking I have behind the scenes, sports has accounted for 70% of all volume at Kalshi. … That means everything else has accounted for less than a third of Kalshi’s volume. About half of the remaining volume came on economic markets. Politics and entertainment/culture capture the rest.”

More on how this compares (or doesn’t) to legal sports betting in the link.

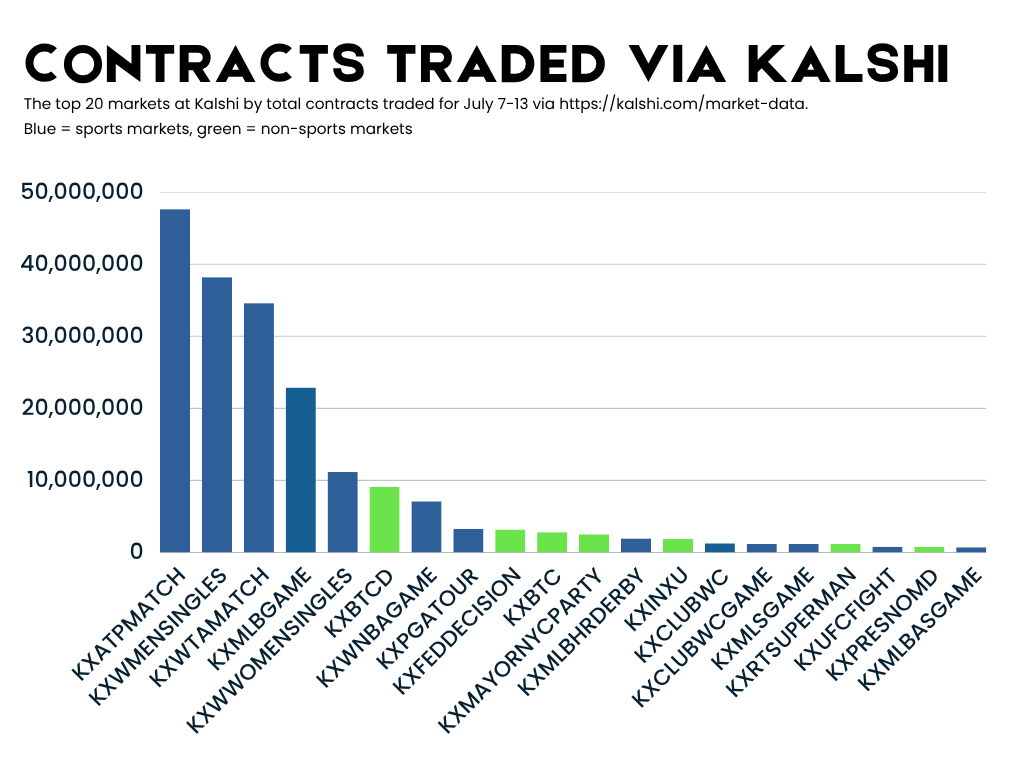

Kalshi Volume Report: Wimbledon Was Almost Two-Thirds Of Trading Last Week (Event Horizon): “Betting on the tennis major accounted for about 63% of all trading from July 6-13. In all, about 82% of all trading volume at Kalshi involved sports. Here’s a look at the top 20 markets in that time period:”

Kalshi Lawyer Digs In As Opponents Circle (InGame): This post is a transcription of what a Kalshi lawyer said during a National Council of Legislators from Gaming States event:

“Responding to Hoenig, who suggested that weekend sports bettors and commodities speculators shouldn’t be painted as the same customer. Sterling had earlier sparred with Hoenig about whether prediction markets threaten the sovereignty of tribal gaming granted by the Indian Gaming Regulatory Act.

Sterling: “I think everybody’s a professional trader that is in these markets. And I think a lot of these people trade a lot of things. And I’ll tell you why that’s true, because if you look at this industry — the industry of trading, I’ll call it — every company out there that I represent, even the ones that I don’t, are trying to build the everything app on their phone because that’s how people aged 25-to-35 view their portfolio.

“They want to trade stocks, zero data expiry options, crypto, FX, events, horses. You name it, they want to trade it because they view that as their financial portfolio. So this isn’t your mom or your dad calling E.F. Hutton to trade stocks at $20 or whatever. This is people trading anything and everything that they can.”

To all of this, I would ask Sterling to search for “Kalshi” on TikTok and check out the influencers telling people to bet on stuff. And then come back and tell me they are catering to “professional traders.”

Kalshi Says Its ‘Odds’ Hats and ‘Bet’ Ads Don’t Make It a Gambling App (Sportico): “A Kalshi official said in a statement that the ‘odds’ and ‘bet’ advertisements have nothing to do with whether the company offers gambling.”

“Any promotional materials or company correspondence referencing ‘betting’ in no way indicates that Kalshi is anything but a financial platform, or change our regulatory status,” the official wrote in an email. “In the same way that you can bet on a stock, derivative or a bond, you can bet on markets on Kalshi.”

Kalshi may be right that it doesn’t end up changing its regulatory status. (Or it may not…The Event Horizon chronicling all the times Kalshi has called itself “betting” has been cited in numerous legal briefs). But Kalshi has literally advertised itself as a legal sports betting platform. And while “betting on stocks” is a phrase that is used, it’s certainly not the most common way to talk about it. Language still matters at the end of the day. If you’re not a betting platform, stop marketing yourself that way.

Don't let prediction markets bypass Iowa's gambling laws (Des Moines Register, opinion piece from AGA president Bill Miller): “For years, Iowa has taken a thoughtful, responsible approach to gambling regulation. From brick-and-mortar casinos to the more recent legalization of sports betting, the state has developed a framework that balances consumer access with public accountability. Iowa’s laws are clear: legal gambling requires licensure, transparency, and a commitment to responsibility. That framework is now under threat from a new wave of so-called “prediction market” platforms, which are federally registered exchanges under the Commodity Futures Trading Commission (CFTC). But make no mistake: many of these platforms offer gambling products, not financial ones.”

This is the second of these the AGA has published, following one on Kansas.

DraftKings in Talks to Acquire Prediction Market Railbird Exchange (Front Office Sports): “DraftKings is currently in acquisition talks with Railbird Exchange, an upstart prediction markets platform that recently gained federal licensure, a source told Front Office Sports. Financial terms were not known, and a deal has not been finalized. ‘DraftKings speaks to a variety of companies regarding various matters in the normal course of business, and it is our general policy not to comment on the specifics of any of those discussions,’ a spokesperson for the sportsbook told FOS in a statement. Railbird did not respond to a request for comment.”

I wrote some thoughts on this at my other newsletter, The Closing Line: Everyone has been talking to everyone over the past few months when it comes to prediction markets. The above is definitely news, but I am sure that DraftKings and FanDuel have kicked the tires on almost any option when it comes to how they approach prediction markets.

If I am DraftKings or FanDuel, I would be prioritizing how to do prediction markets myself rather than partnering with Kalshi. I am not sure why sportsbooks would plug into Kalshi and help them become the dominant force in federally regulated sports betting if there is some path to do it without them. Maybe working with Kalshi is how DraftKings and FanDuel initially enter the market, but it could prove short-sighted.

Railbird is particularly interesting for DraftKings (or anyone looking to get into sports betting prediction markets), as it’s a green-field opportunity. Railbird just got approval from the Commodity Futures Trading Commission and isn’t even live yet.

In one of the most meta things ever created, you can bet on whether DraftKings will acquire Railbird at Polymarket:

US CFTC Begins Staff Firings, Agency Source Says (US News/Reuters): “The U.S. Commodity Futures Trading Commission on Wednesday began staff firings that are expected to affect over two dozen people, according to an agency source, after the Supreme Court last week cleared the way for mass government firings. Employees from the CFTC's enforcement, market oversight, administration and data divisions are expected to be affected as part of a more general reorganization at the regulator, the source said. The CFTC had 636 full-time equivalent staff positions in fiscal 2025, according to an agency report. The regulator has also recently reduced significant numbers of staff through a series of voluntary resignation programs that were also offered in other agencies.”

From LinkedIn, here’s Cantrell Dumas, the director of derivatives policy at the non-profit Better Markets, “I’m deeply concerned by the announcement that the CFTC has begun firing more than two dozen of its staff. This isn’t belt-tightening. It’s self-sabotage. The agency is already stretched thin, struggling to meet its core mandates. Now it's cutting even more staff while pushing to oversee sports gambling, crypto, and 24/7 trading? That’s like grounding firefighters during wildfire season. Make it make sense.”

Kalshi and Polymarket offer betting on the viral Astronomer CEO: If you are living under a rock (or if you spend a healthy amount of time offline), you may not have seen the story about the CEO of a company called Astronomer getting caught having an affair with his head of HR at a Coldplay concert. Neither of the major prediction markets wasted any time getting markets up.

Kalshi only has one, but it’s the “featured” market and has almost half a million dollars in volume:

Polymarket has a similar market, but also a more tasteless one about whether both of the Astronomer execs will get divorced:

Polymarket Probe Ended by DOJ in Win for Crypto Bets Under Trump (Bloomberg, paywall): “A pair of US investigations into crypto-betting platform Polymarket that went full-throttle in the waning days of the Biden administration are now being shut down just as Donald Trump’s White House seeks to give the industry a boost. The predictions exchange received formal notice earlier this month from the US Justice Department and Commodity Futures Trading Commission that the probes had ended, according to a person with direct knowledge of the matter, who asked not to be identified discussing the confidential inquiries.”

If this is a first step toward an official return of Polymarket to the US, that would be a major shakeup for the nascent prediction markets industry. Of course, there are clearly Americans betting on Polymarket already, which is ironic because that’s reportedly what the DOJ was investigating.

What Five New Academic Papers Say About Prediction Markets (The Event Horizon): “Prediction markets are having a moment in academia. There have been at least five academic papers published since the start of May that are about prediction markets and exchanges or tackle issues around them. And those are on top of the Journal on Prediction Markets, which is working on a US-based issue now.”

Click through for more on all the papers and links.

It turns out the above wasn’t an exhaustive list:

Event Contracts Are a Step Too Far for Derivatives Regulation: Abstract: This Article develops two branches of history towards understanding derivatives markets and their regulation. First, using a comprehensive database of derivatives products that the Commodity Futures Trading Commission (CFTC) has authorized, this Article traces stages in the development of derivatives products. The empirical study examines key evolutionary steps from the birth of agricultural futures in the second half of the 1800s to where traders now bet on how long Taylor Swift’s most recent album dominates the Billboard 200, whether the President will pardon specific individuals, or how many times Bill Ackman (a notable hedge fund manager) accuses MIT professors of plagiarism. Second, the Article examines the statutory goals of the primary source of derivatives regulation: the Commodity Exchange Act (CEA). From their enunciation in the Grain Futures Act of 1922 to their most recent amendment under the Commodity Futures Modernization Act of 2000, these goals have consistently viewed derivatives as a means to benefiting Main Street rather than an ends in themselves. Specifically, the twin goals of the CEA are enabling hedging and price discovery in the “cash” markets underlying derivatives instruments. This Article argues that these goals may also serve as a limiting principle, enabling the CFTC to conclude that an instrument that fails to advance either goal is beyond the reach of the CEA. The jurisdictional boundary is significant because products the CFTC authorizes fall into the CFTC’s exclusive jurisdiction, preempting state law and displacing other federal regulation. This Article concludes that the CFTC has authority to require exchanges it regulates to delist a range of contracts (referred to as “event contracts” or “prediction products”) that fail to adequately serve the public interests motivating the CEA, instead shifting them to regulation under state law including state law restrictions on gambling. This approach is a powerful alternative to the strategy the CFTC has pursued in court to prevent exchanges from listing event contracts that settle on the basis of election outcomes and a narrow set of other socially sensitive activities.

Don't Bet on It: Sports Betting and Consequential Detrimental Impact: This one comes from earlier this year and isn’t entirely about prediction markets, but it does touch on them.

Abstract: In 2018, the U.S. Supreme Court’s decision in Murphy v. NCAA struck down the Professional and Amateur Sports Protection Act (PASPA). Since 1992, this federal law had prohibited most states from allowing sports betting, with some limited exceptions. Following the landmark ruling in Murphy, 38 states and the District of Columbia have moved to permit various forms of legalized sports betting. The industry is growing exponentially, reaching almost $150 billion in total legalized bets in 2024, and $14 billion in revenues.

Both states and professional sports leagues are profiting handsomely from this burgeoning new sector. Unfortunately, legalized sports gambling is not without negative consequences; studies show it can lead to addiction as well as financial and mental health distress. Utilizing data available from six years of legalized sports betting and numerous studies, this article shows that sports betting participation, especially for the targeted demographic (males 18-40), detracts from the capability to invest long term as well as save for retirement. Betting on sports now has a similar feel to investing in the stock market, but provides instant gratification (or loss, as is more often the case).

Since sports betting will continue to grow for the foreseeable future, this article provides insights on the sector, as well as potential guardrails and policies to address the associated detrimental impact.

On prediction markets: “Despite these two early wins by Kalshi, the regulatory issues for sports event contracts are murky at best, considering the repeal of PASPA gave the power to regulate sports betting to the states without Congressional action otherwise. Moreover, the CFTC, which derives its power to regulate under the Commodity Exchange Act, has Rule 40.11(a)(1), which prohibits contracts “based on... gaming.” Kalshi made this argument when winning the right to offer political event contracts – that those contracts were not gaming or sports betting.”

“Whether this eventually ends up in the Supreme Court, or if Congress takes action, or if the CFTC develops new policies that allow for gaming in this new frontier of predictive markets remains to be seen. Nevertheless, these recent developments indicate a further blending of investments with sports betting – without acknowledgement or current regulations that these event contracts are the same as sports betting, with the ‘investor’ only earning money if their team wins. Moreover, these event contracts are not akin to long term equity investing, but the products are becoming so blended as they are offered under similar platforms such as Robinhood.”

Odds and ends and other reads:

PredictIt Gets Upgrades After New Deal With CFTC (The Event Horizon): PredictIt — an early legal prediction market for election betting dating back to 2014 — is taking a big step forward, with the help of the Commodity Futures Trading Commission. The platform that focuses on politics and elections announced a new agreement with the CFTC on Tuesday that includes several major changes. “I’m thrilled,” PredictIt co-founder John Phillips told The Event Horizon in an interview after the announcement. “These markets are great engagement tools in the political process, and it’s a good thing to get people more engaged.”

Robinhood Has The Highest Margin In Sports (BLSH News): “By our math, while FanDuel holds $10 to Robinhood’s $3.57 at the top-line, Robinhood keeps $3.38 net of direct costs to Fanduel’s $2.55. Obviously some of the lower costs Robinhood is able to enjoy come as a result of how they’re classified as a federally regulated futures broker, but other advantages relative to OSB operators are due to entrenched scale and product advantages such as a lower cost of payments and next to no promotions.”

Kalshi Adjusts Odds, Citing ‘Large Trader’ Glitch, For Unusual MLB Bets (InGame): “Kalshi has adjusted the odds on a number of unusual bets made earlier this month, after what InGame understands to be a technical error involving a large trader’s systems. However, the new odds for the trades may raise questions about how adjusted prices are determined. While trades on some games seem to have been adjusted back to fair market value, trades for other games were changed to prices that still appear far from what might be expected.”

Legal Doctrine Addressing ‘Obnoxious’ Lawmaking May Factor In Prediction-Market Litigation (InGame): “A legal doctrine described by the Supreme Court as “obnoxious” almost 90 years ago has emerged in the lawsuit between Kalshi and New Jersey regulators. Enter the nondelegation doctrine, a legal principle that constrains congressional gifting of power. … What is the nondelegation doctrine? And how could it potentially apply in the ongoing prediction-market lawsuits percolating in New Jersey, Nevada, and Maryland? Here is a primer.”

‘Ask Polymarket’ Account Launches on X, Powered by Grok AI (Prediction News): “Popular prediction market platform Polymarket has launched a new AI-powered interactive account on X. The @AskPolymarket account lets X users tag it and ask questions, to which it responds with answers connected to markets and corresponding odds available at Polymarket. The description of the X account says it is “powered by Polymarket + Grok 4,” making it the latest collaboration between the prediction market platform and the xAI product.”

Robinhood’s sports betting markets currently include two markets on The Open Championship in golf and match winners for UFC 318.

I enjoyed this tweet:

Ridiculous things you can

bettrade on at prediction markets: