The Closing Bell: Robinhood Talks Kalshi Deal, Sports Betting In Q1 Earnings

Prediction markets roundup: Sporttrade asks CFTC to nationwide; NBA, more regulators weigh in; Kalshi wins early victory in New Jersey; Kentucky Derby in sports event trading?

Robinhood’s partnership with Kalshi and its continued rollout of prediction markets — including sports betting — was a major theme of the Q1 earnings call of the trading platform.

The top-line number is that Robinhood has seen a billion contracts traded via prediction markets. And while half of that came on the November elections, most of the rest came on sports, including March Madness betting.

The continuing legal issues surrounding sports event contracts did not come up.

Here is some of what CEO Vlad Tenev and CFO Jason Warnick said on prediction markets in the earnings call.

Tenev: “So let's get into it in a little bit more detail. When I look at our active trader offering, it just keeps getting more disruptive. We launched futures and prediction markets in Q1, and futures are accelerating nicely. So about 4.5 million contracts traded in April alone, which is more than all of Q1. So Q1, which was a strong quarter, greatly was accelerated in April. And prediction markets have done over 1 billion contracts in the last six months. And we've recently started to increase the breadth of the contracts we offer. So we're still very much in the early stages there.”

Warnick: “For example, we've recently launched three new products. Futures, index options and prediction markets, where the ARR for each of them individually is already around $20 million.”

Question: “Hey, guys. Thanks for taking my question. It's on prediction markets. So one billion traded over the last six months, does that basically leave us with 500 million or so that are out -- that was outside the November election? And then any sense how much was kind of March Madness or sports-related versus other events?”

Tenev: “Yeah. That's right. I'll be happy to field that one. So out of the one billion contracts traded, yeah, just less than half of that has been sports, and that's March Madness, but we also had The Masters and now there's NHL and NBA contracts as well. So the plan is still continue making the product better. Now that we have so many contracts, discoverability and organizations, something that the team is looking at. And we think that this is an incredibly powerful nascent asset class, and you should see more and more contracts and a wide variety of contracts over time. So, we love what we're seeing and it's so early that the potential of this is vast.”

Question: “I'd love to get some better insights into sort of the event and prediction market business. Are these participants more like your equity option or crypto customers today? What sort of penetration would you expect in the prediction markets of these customers over time? And then, do prediction market customers have sort of higher or lower velocity than the other segments of your business? Are these like super active or are they more or less active? Like, where do they fit into the continuum of your customers?”

Tenev: “Yeah. I think the great thing about this business -- about the prediction markets business is that it appeals to a broad range of customers, and we actually see very, very different behaviors, even within prediction markets when you talk about different contracts. So for example, the group of customers that engages with the economic prediction markets, is not the same group of customers that engage with The Masters for instance. And so many of young people who are our customer base, love sports and love following news and current events. So actually, what you see is like pretty wide dispersion. Yeah. It's not like other assets where if you're an options trader, a number of options traders are coming and primarily engaging with that. You see these customers engaging in a wide spectrum of assets and sort of, like trading activity quite broad and varied among the rest of our products.”

Here’s Tenev talking about prediction markets on a Bloomberg interview as well; h/t Alfonso Straffon on Twitter/X. 8-minute mark:

Closing Line Consulting

I have been a trusted analyst and executive in the gambling space for more than a decade. I don’t just write newsletters; I work with a number of companies in gaming. Learn more about CLC here.

The Closing Bell

A roundup of prediction markets news, analysis and other thoughts:

New letters to the CFTC from NBA, regulators: Despite the CFTC cancelling the prediction markets roundtable, we are still getting letters and testimony posted on the CFTC’s site. A few highlights:

The NBA: “Without oversight and regulation tailored to the specific circumstances of sports wagering, the integrity risks posed by sports prediction markets are more significant and more difficult to manage than those presented by legal, regulated sports gambling,” reads the letter, signed by Alexandra Roth, the NBA’s vice president and assistant general counsel for league governance & policy.

We also heard from NBA Commissioner Adam Silver at the Associated Press Sports Editors Commissioners Meetings; per Bookies.com: “These new trading markets, we're watching them very closely. We are not participating in them. We are not accepting advertising money from them. I am concerned about what integrity protections are in place for those trading platforms. And our strong preference again would be for those to be regulated markets. We think that puts us in the best possible position.”

Pennsylvania: “The introduction of sports prediction markets operating under purported federal oversight poses a direct threat to the comprehensive regulatory system Pennsylvania – and many other state jurisdictions – have meticulously constructed for gaming, including sports wagering. With all due respect to this body, it would take years for the CFTC to create the regulatory system and oversight that state gaming authorities have in place and, were you to do that, it would create a redundancy to something that already exists and works exceptionally well. …”

In that link, there is also information about letters from Illinois and Maryland. Regulators from both states had already sent cease-and-desist letters to Kalshi.

Michigan: “The MGCB is also concerned that the availability of sporting event contracts will cause financial harm to state, local, and tribal governments in Michigan. … Finally, the MGCB is concerned that the promotion of sporting event contracts as an investment vehicle is antithetical to the agency’s stance and foundational message on responsible gaming'…”

Sports betting veteran Alfonso Straffon: “If powerful interest groups want sports betting to be regulated by a Federal body so that they can expand across all states, while at the same time opening it up to institutional players, would it not be better for the Congress to create and pass a sports betting-specific Act that eliminates any ambiguity and sets a more solid foundation instead of having to rely on subjective interpretations, loopholes, and word-smithing. … While the CFTC may want to refrain from calling what Kalshi is providing on their platform “sports betting” or “sports gambling” or whatever equivalent, it is abundantly clear that betting on sports is precisely the product being offered to its users. … As someone who has worked in both trenches here, making markets for bookmakers and then as a junk bond trader, there is no doubt that market makers are bookmakers, and that bookmakers are market makers. While audacious, it is rather naïve and insulting to say otherwise.”

I had a hard time taking this one seriously, but I’ll include it anyway. The author uses this nonsense as his first example of a legitimate hedging activity for sports events: “During the 2022 baseball season, Texas-based Gallery Furniture ran a promotion by which all customers would receive a $3,000 refund on furniture purchases if the Houston Astros were to win the 2022 World Series. The promotion exposed Jim McIngvale, Gallery Furniture’s owner, to a $50 million loss if the Astros were to win. To hedge this risk, McIngvale placed a bet of $10 million on the Astros to win the World Series at 7.5-to-1 odds. More details of the story are covered by Porterfield (Forbes, 2022).”

Yes, sure, the infamous Mattress Mack is “hedging” his furniture promotion. But he created the scenario himself! He literally creates furniture promotions so he can gamble! There are valid economic reasons to hedge outcomes of sporting events, but an Astroturfed hedging scenario to gamble large sums of money ain’t one of them.

Sporttrade wants to become a nationwide sports betting exchange: This comes from the CFTC letters as well, I included it as part of a larger column over at The Closing Line. Sporttrade is a state-regulated sports betting exchange in five states, and it’s asking the CFTC if it can go nationwide. From the letter:

“…we would ask the CFTC to apply discretion given the extraordinary unique circumstances to provide no action relief towards Sporttrade given our track record of operating a compliant event contract exchange under the regulatory scrutiny of multiple state gaming regulatory bodies. We would expect that such relief would require evidence that Sporttrade can satisfy all CFTC reporting requirements and Core Principles, which is something we are prepared to do. In a gap analysis to understand our current regulatory obligations versus what would be required of a DCM, we believe there is a significant overlap…. At the time of writing, Sporttrade is preparing a formal no-action relief request that in effect will demonstrate that Sporttrade can satisfy all Core Principles and reporting requirements to list a small, select set of sports contracts that we can demonstrate are within public interest. The CFTC has numerous times in the past granted no action relief to exchange venues to accept trades on event contracts without formal federal registration, most notably with Iowa Electronic Markets and Victoria University of Wellington.”

Sporttrade is kind of the poster child of why some disruption might be good in the legal sports betting industry. With its model, state licensing and taxation regimes are onerous; we’ve seen the rise of things like fantasy pick’em, sweepstakes casinos/sportsbooks, and sports event contracts precisely because state-level regulation can serve to stifle innovation and competition in regulated gambling. If we’re going to have nationwide sports betting, Sporttrade should arguably be at the forefront of it.

I don’t agree with this, for the record: “There are two potential solutions to the current uneven playing field. One would involve barring DCMs from offering sports contracts, at least for some period of time. We would not endorse this approach, as we feel the exchange concept offered to players who want to speculate on sports outcomes is fairer and more transparent than sportsbook alternatives.” I think everything should get shut down because this rollout has been a circus, from where I sit. I am, however, sympathetic and supportive of Sporttrade’s ambition in a world where we have federally legal sports event contracts, and no one is capable or willing to stop them.

God bless CEO Alex Kane for saying this to Sportico: “You’re not going to hear me say this isn’t sports betting... That’s a ridiculous comment.”

Greenblatt: Prediction markets pose opportunity and risk for BetMGM (SBC Americas): “BetMGM CEO Adam Greenblatt suggested on Monday that the company will only look to participate in offering event contracts ‘if required’ as the legality of prediction markets continues to be cloaked in uncertainty.

Asked during the Q&A section of the company’s Q1 2025 earnings call, Greenblatt noted that prediction markets ‘live at the inttersection between state rights and who has the jurisdiction to regulate gaming at a state level’ and will be determined by the courts.”

“Whether it represents a risk or an opportunity, things are elements of both, actually,” he suggested. “But in our existing online sports betting states, it represents a degree of small risk, only because the markets that prediction markets serve would be lower-margin for operators. There would be no impediment to sports betting operators participating in that market so we wouldn’t lose that business in time, it would just come into less revenue for the operator.”

“Things like the excitement of same-game parlay, the features of a rich sports betting experience that sports betting operators provide, would not be available,” he added. “There isn’t an equivalent in that type of offering. So, while it certainly is something we are monitoring … we will participate if required. Otherwise, we’re focusing on just being the best sports betting operator in the current regulatory environment.”

People keep saying the product for sports event trading isn’t or won’t be as good as sportsbooks. Sure, that’s the case today. If all of this moves forward unabated, do we all really think that’s going to be the case? The number of markets and the quality of the product will only improve. And I keep seeing the idea that parlays won’t be a part of sports event trading. Kalshi had already rolled out a limited version of parlays prior to launching sports betting; it’s only a matter of time before parlays start being deployed in earnest. Kalshi has also captured something exciting in live betting that sportsbooks are not as good at, and they arguably should learn from.

Cease and desist tracker: Kalshi won a preliminary injunction from a federal judge in its case against New Jersey, which is arguing it’s offering sports betting. Some legal analysis from attorney Andrew Kim here:

“I’ll not mince words: I think the decision is poorly reasoned, and I don’t know if it’ll hold up on appeal. Here are four reasons why. First, the breezy 16-page opinion has four pages of analysis on the legal merits (the “likelihood of success” analysis). Four. I don’t have to look very hard to know that the State’s arguments got short shrift.”

Otherwise, not a ton of material action, with no new C&D’s issued, at least that are publicly known. In Maryland, Crypto.com also sued the state in addition to Kalshi. A hearing on Kalshi’s requested preliminary injunction will take place on May 28 in Maryland.

Will Kalshi do the Kentucky Derby?: So far, Kalshi has not put up any markets for the Kentucky Derby. Users on the Kalshi Discord channel have been asking for them with some regularity. With just a couple of days till the race and the opportunities for betting during the two-minute event both limited and potentially problematic, we may not be seeing it. Also, Kalshi has already pissed off much of the gambling industry ecosystem with sports betting. Offering horse racing — including the intersection with the Interstate Horseracing Act — is a whole new hornets’ nest. Polymarket (which does not technically serve the US), does have Kentucky Derby betting.

Kalshi partners with Worldcoin:

News/presser from World: “Prediction markets are emerging as one of the most exciting frontiers in financial markets, offering a powerful new way to bring truth and transparency to the world. Through an integration with industry pioneer Kalshi, you can now participate in prediction markets directly from World App using the new Kalshi Mini App. Funding your Kalshi account with Worldcoin (WLD) on Kalshi’s sleek new Mini App is super simple, providing a first-class user experience. Fund partner Zero Hash seamlessly and securely converts your WLD to USD, funding your Kalshi Mini App account instantly, anytime, and with no friction. … Kalshi has been selective in which crypto it has chosen to adopt. So far, it has only accepted BTC and USDC, in addition to fiat. This integration brings WLD, one of the most distributed tokens in the world (with more than 8.6M WLD funded wallets and counting in World App) to Kalshi.”

Kalshi CEO Tarek Mansour on social media: “I am very excited to partner with Sam Altman and the World team to make access to prediction markets easier for millions of Americans. It was awesome to support the launch of World last night alongside Stripe, Visa and Tinder as the other launch partners. There is now a Kalshi mini app on World and holders can deposit on Kalshi using the $WLD token. I am proud of how fast the two teams executed to make this happen: it took less than a month from idea to launch.”

While you can currently deposit cryptocurrency on Kalshi, users have not been able to withdraw it in recent weeks, with users on Discord complaining about the lack of progress. A Kalshi employee posted this morning that “Our Team is working around the clock to get crypto withdrawals back up and running. Sorry about that!”

Kalshi backtracks on maker fees for NBA: This email went out to some users on fees on NBA contracts on Wednesday evening: “Starting on Friday (May 2, 2025) at 8 am ET, there will be some fee changes: Makers (Limit Orders): $0.005 per contract.” That was double the previous fee.

The increase in fees for those trades apparently went over like a lead balloon; this email went out four hours later: “Kalshi understands that raising fees is never welcome news, and these decisions are never made lightly. We sincerely appreciate all of the feedback you have given us, which has helped lead us to reverse this decision. Our relationship with you is critical, and we have decided to forgo this fee increase, which was intended to combat rising costs. There will be no fee changes to any contracts on Kalshi. To be clear, the fees charged for market makers (for events that already have market maker fees) will remain the following: Makers (Limit Orders): $0.0025 per contract.”

It was enough of a kerfuffle that co-founder Luana Lopes Lara was speaking with some of the folks who were pissed about the fee hike via Discord.

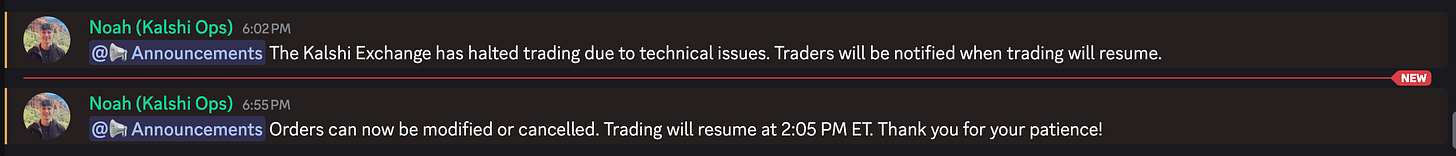

Exploring Kalshi's Exchange Halt (Adjacent Press): “Kalshi halted their exchange at 1p ET on April 29th 2025 and resumed trading at 2:05p ET that same day.

This was unexpected and unannounced and I wanted to know if anything weird happened right before or right after the halt. Did anyone significantly lose money on any daily financial markets that were expiring within a few hours, what about mention markets with speeches about to start? The entire observable notebook where this is explored can be found at observablehq.com/@adjacent/kalshi-exchange-halt where you can fork and play around with specific markets during the halt time.”

“Overall not much really happened due to the exchange halt, most markets continued to trade inline, some dailys resolving right before or shortly after where a little funky but for the most part the markets that were traded on right before and after have extremely low volume. Either way this notebook will serve as a good tool incase the exchange halts again during larger trading events.”

Ridiculous things you can

bettrade on at prediction markets:Polymarket edition: Will Donald Trump be the next Pope? LOL.

Kalshi edition: “Will there be a One Direction reunion this year?” Looking through Kalshi markets is the Story of My Life.

Runner-up: A market that isn’t live yet that Kalshi just self-certified: “Will Shannon Sharpe appear on ESPN before date.” I guess this would be an amazing way to hedge if you’re Shannon Sharpe.

Other things I have published this week on prediction markets

I wrote a rant on LinkedIn: “Which brings me to Kalshi and the current world of legal sports betting. Would I mind having full-blown sports betting in 50 states? Not at all. It would be a pretty ironic outcome given the history of US sports betting, and it could end up being a net positive (probably not states that get tax revenue from legal sports betting now). Kalshi may very well end up being right that it is on the right side of the law. What I disagree with is the ‘how.’ Kalshi leaned into gambling terminology for months; now it gaslights us, telling us it's ridiculous to call what they are offering ‘sports betting.’ The CFTC has created an absolute shitshow by saying basically nothing about all of this, and by jerking everyone around with a roundtable that didn't happen.”

And finally:

Sports Accounted For 75% Of Contracts At Kalshi This Weekend

Data from Kalshi shows that about three-quarters of all trading volume via the prediction market platform over the weekend came from people betting on sports.

Sports market update

Here are the sports markets that Kalshi currently offers as of Friday morning (Bold and italics for additions since last week):

Basketball, 8 + game-winner markets: Moneyline betting on single games, playoff series winners, NBA and WNBA futures markets.

Baseball, 11 + game-winner markets: Moneyline betting on single games, World Series, AL, NL and division winner markets; 2025 College World Series champion; and 2026 World Baseball Classic champion.

Football, 18: College football champion, college conference champions, Super Bowl champion, NFL division and conference winners, and UFL champion and “will the tush push be banned?”

Soccer, 8 + game-winner markets: League futures for various international leagues. New this week are single-game three-way markets for Champions League matches.

Tennis, 4 + single-match markets: Champions of major tournaments, ATP Madrid matches.

Golf, 7: Current PGA Tour and LIV Golf events. Major men’s tournament winners and team competition winners.

Formula 1, 7: Miami Grand Prix markets, Drivers Champion, Constructors Champion and props.

Hockey, 5 + game-winner markets: Moneyline betting on single games, playoff series winners, Stanley Cup winner, conference final winners.

Cricket, 1: IPL winner.

eSports, 1: League of Legends champion market.

Boxing, 1: Garcia vs. Romero

Other platforms:

Crypto.com offers a much smaller portfolio of markets, but does allow betting on single NBA and NHL games.

Robinhood offers NBA and NHL futures markets, including series winners.