The Closing Bell: Polymarket Makes Time's 100 Most Influential Companies of 2025

Roundup: New prediction market Railbird inks a deal with a tech platform; revisiting the NYC mayor's race and Kalshi and Polymarket's unicorn status; Kalshi changes maker fees.

The Closing Bell is a roundup of prediction market news, analysis, and other thoughts each Friday.

While Time is certainly not the media powerhouse it once was, people still take notice when you get on one of its lists.

In a week where the Kalshi vs. Polymarket rivalry was on full display with billion-dollar valuations, it was the international prediction market getting the nod in Time’s Most Influential Companies for the year:

You can see the entry on Polymarket here and below:

Over the last year, online prediction markets—which allow people to bet on the outcome of upcoming events—have exploded in popularity. In the run-up to the 2024 U.S. election, users of the biggest prediction site, Polymarket, spent $1.5 million betting on a Donald Trump victory compared to $1 million on Kamala Harris, providing an early signal of Trump’s support and momentum—and suggesting that bets can predict the future better than polls. With users placing crypto bets on everything from soccer matches to military action between India and Pakistan, Polymarket regularly facilitates more than $800 million a month in trading volume—well above competitor Kalshi. (Seeing a growth opportunity, Robinhood launched its own prediction markets hub in March.) There have been setbacks, however. After the election, FBI agents raided CEO Shayne Coplan’s apartment and seized devices, part of an apparent investigation into whether Polymarket illegally allowed U.S.-based users to place bets; the company has not registered with federal regulators. And in May, Polymarket’s reputation took a different kind of hit when Robert Francis Prevost was given less than a 1% chance of becoming pope, with users betting more than $28 million on other candidates.

The roundup

Kalshi And Polymarket Are Both Unicorns (Event Horizon): “The two biggest prediction markets are reportedly both unicorns valued at more than a billion dollars after recent raises. Kalshi raised $185 million at a valuation of $2 billion according to CEO Tarek Mansour … At the same time, reports indicated that Polymarket was close to closing a round of $200 million that values the company at over a billion dollars.”

Here’s Mansour on CNBC.

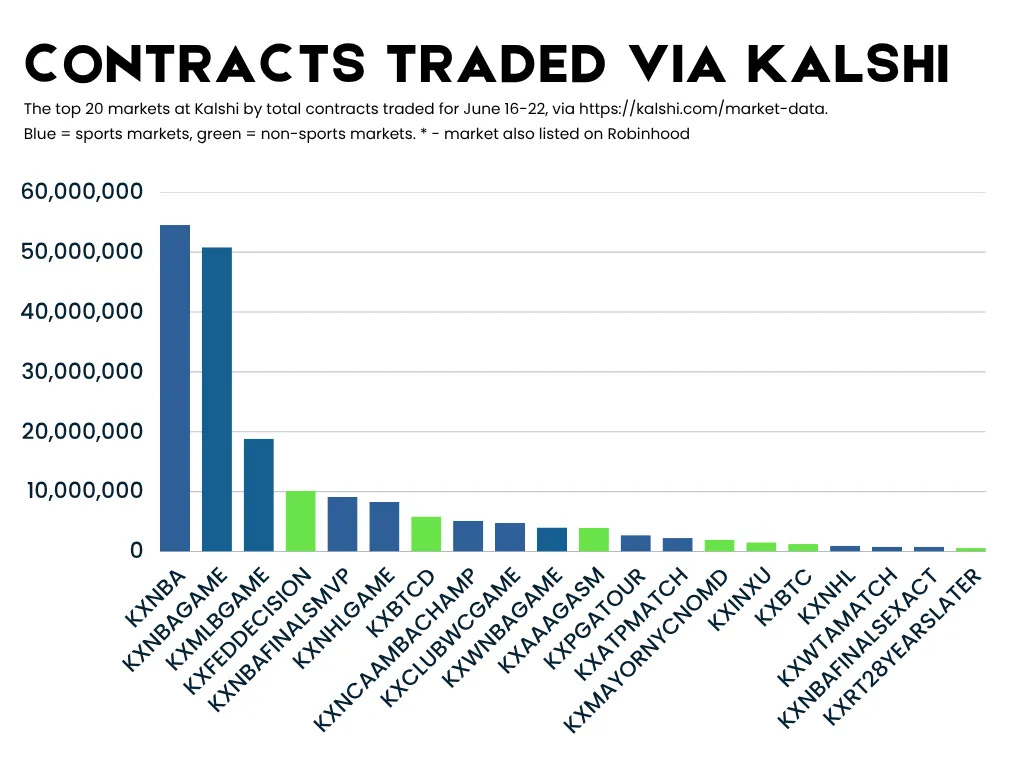

There is a lot of breathless writing and tweeting about Kalshi being on a rocket ship to the moon without mentioning that that trajectory is tied almost entirely to its future in sports betting. Mansour above does at least acknowledge that sports has been a big part of Kalshi’s growth. But everything else Kalshi is doing (outside of presidential elections) is chicken feed. If sports betting goes away, the valuation turns into fairy dust. But of course sports betting may not go away, and the rocket ship would continue to soar.

Railbird Exchange Selects Connamara Technologies' EP3® Platform to Power Regulated Prediction Market (press release): “Connamara Technologies, a leading provider of fully integrated exchange technology solutions, is pleased to announce that Railbird Exchange has selected its EP3 exchange platform to power its newly approved U.S. regulated prediction market.

Founded in 2021, Railbird Exchange allows users to trade on the outcomes of real-world events – including economic indicators, entertainment, and cultural moments. On June 13, 2025, Railbird was granted status as a Designated Contract Market (DCM) by the U.S. Commodity Futures Trading Commission (CFTC), with plans to launch later this year.

“Railbird joins a growing roster of innovative markets across the globe choosing EP3 to reduce time to market and total cost of ownership. As a newly approved DCM focused on a fast-evolving asset class, Railbird exemplifies the type of forward-thinking exchange that EP3 is purpose-built to support.”

"We made the decision to partner with Connamara well ahead of our regulatory approval, and the experience since has only reinforced that choice. EP3 has given us the flexibility, reliability, and support we need to bring a unique, regulated prediction market to life. Their team's deep expertise and responsiveness have been instrumental in getting us ready for launch," said Miles Saffran, Co-Founder of Railbird Exchange.

"We're proud to support Railbird's mission to build a transparent, CFTC-regulated marketplace for event-based contracts," said Jim Downs, Co-Founder and CEO of Connamara Technologies. "Our work together reflects how EP3 enables new exchanges to launch quickly, scale confidently, and meet the demands of modern trading participants."

Connamara works with ForecastEx in the prediction markets space, among other customers.

The dream scenario for prediction markets (The Economist, paywall): “If you could invent something to fulfill an economist’s dream, it would look an awful lot like a prediction market. A world where every uncertain future can be priced, hedged and insured against? Kenneth Arrow and Gérard Debreu would approve. A market mechanism to co-ordinate the decentralised wisdom of crowds, ensuring the accuracy of such prices? Adam Smith and Friedrich Hayek sought just that. In recent years, the fantasy has crept closer to reality. Platforms that allow users to speculate on current affairs and more have seen remarkable surges in volume and visibility. On Polymarket, the largest, traders wagered over $1bn last month, up from $63m a year before. In both the court of public opinion and the actual courts, exchanges have scored significant victories. Most important, their forecasts have held up: where opinion polls cast November’s presidential election as a toss-up, prediction markets priced in a victory for Donald Trump.”

New briefs filed in Maryland: Hat tip to attorney Daniel Wallach with some thoughts on briefs in Kalshi vs. Maryland, where Kalshi is trying to stop the state from enforcing a cease-and-desist for offering illegal sports betting. You can see them both below; next up is a decision from the judge on Kalshi’s ask for a preliminary injunction.

Also, the judge just ruled that the court would accept an amicus brief from a group of tribal gaming interests supporting Maryland (again credit to Wallach).

A final look at the Democratic primary for NYC mayor: I wrote about the race and how prediction markets were dealing with the race both before and after the votes were counted. Is it important that Kalshi and Polymarket didn’t outperform polls here? Not particularly; prediction markets are just giving us a look at how a liquid market prices an event. Sometimes they will be better than polls, and sometimes not. I mostly care about this because Polymarket and Kalshi have been telling us since November that polls are crap and prediction markets are all that matter. Here, a late poll dropped, the market moved dramatically because of the poll toward the eventual winner, Zohran Mamdani, then settled on Andrew Cuomo as the favorite when polls closed.

A footnote on all of this. Kalshi and Polymarket were screaming from the rafters that they called the race first, and that it beat mainstream media. We can argue on the accuracy of all that — I saw at least one prominent pollster call it first. But I think it’s interesting that Kalshi and Polymarket, despite “calling” the race on social media, still haven’t closed and graded the market (see below). The markets are still open. And Kalshi also says that the only source that can verify the outcome is the New York Times. That’s despite the fact that Kalshi and Polymarket routinely say they are “the news” moreso than the mainstream media. (The NYT has clearly called the race.) I understand Kalshi, in particular, has to be certain on market resolutions as a CFTC entity, but still… it appears the markets might be waiting for the vote tabulation to complete next week.

People are still buying “Yes” on Andrew Cuomo to win on both platforms!

If you watch the CNBC clip above, there ends up being a lot of talk about the NYC mayoral primary. Mansour is far less bombastic about polls in this interview, and (paraphrasing) says that he hopes polls and prediction markets help each other. That’s far different from his tone in November where he said ad nauseam that polls are failing and markets are the “source of truth.” If this is the new tone from Kalshi, that would be a welcome shift.

I see some people on Twitter saying that people are now going to Kalshi and Polymarket for news and to follow events and their odds in real time. I don’t doubt that some of that goes on in the world. But I am highly skeptical that average people are using prediction markets in this way at all, or that a critical mass of normies have even heard of Kalshi. When I bring it up to family and friends, they look at me like I am an alien.

If you are really interested in how prediction markets have performed for elections in recent history, I highly suggest subscribing to the Imperfect Information Substack. A couple of pieces on this subject:

Kalshi changes maker fees (email to users): “We're writing to inform you about an upcoming change to our maker fees, designed to better align with market dynamics and ensure the long-term health and liquidity of our markets. This change helps ensure that makers consistently benefit from lower fees compared to takers.

This only applies to certain markets that have maker fees; markets that currently do not have maker fees will remain unchanged.

Effective market open on July 1, 2025, the fee for limit orders that are filled will transition from a flat fee of $0.0025 per contract traded to a new, dynamic formula. In short, this represents a fee that is approximately 25% of our current taker fees. The following new maker fee structure is updated in our fee schedule and is shown below:

fees = round up(0.0175 x C x P x (1-P))C = The number of contracts being traded

P = The price of a contract in dollars (e.g., $0.50 is 0.5)

This new structure is designed to create a more balanced and efficient fee system that reflects the value and risk associated with different contract prices.

This system will also ensure that traders using limit orders are not disproportionately charged fees in comparison to market takers.”The tl;dr version is that fees will be lower for makers on low and high probability contracts, and higher for trading markets that are more uncertain in the middle.

Kalshi Volume Report: With NBA, NHL Over, Now What? (Event Horizon): “The NBA and NHL finals accounted for more than 60% of all trading at Kalshi last week. But with the men’s pro basketball and hockey seasons over, there may not be anything that will immediately replace them at the prediction market platform. Sports overall accounted for more than 80% of all volume for the week. Here’s a look at the top 20 markets by trading volume at Kalshi June 16-22:”

Odds and ends

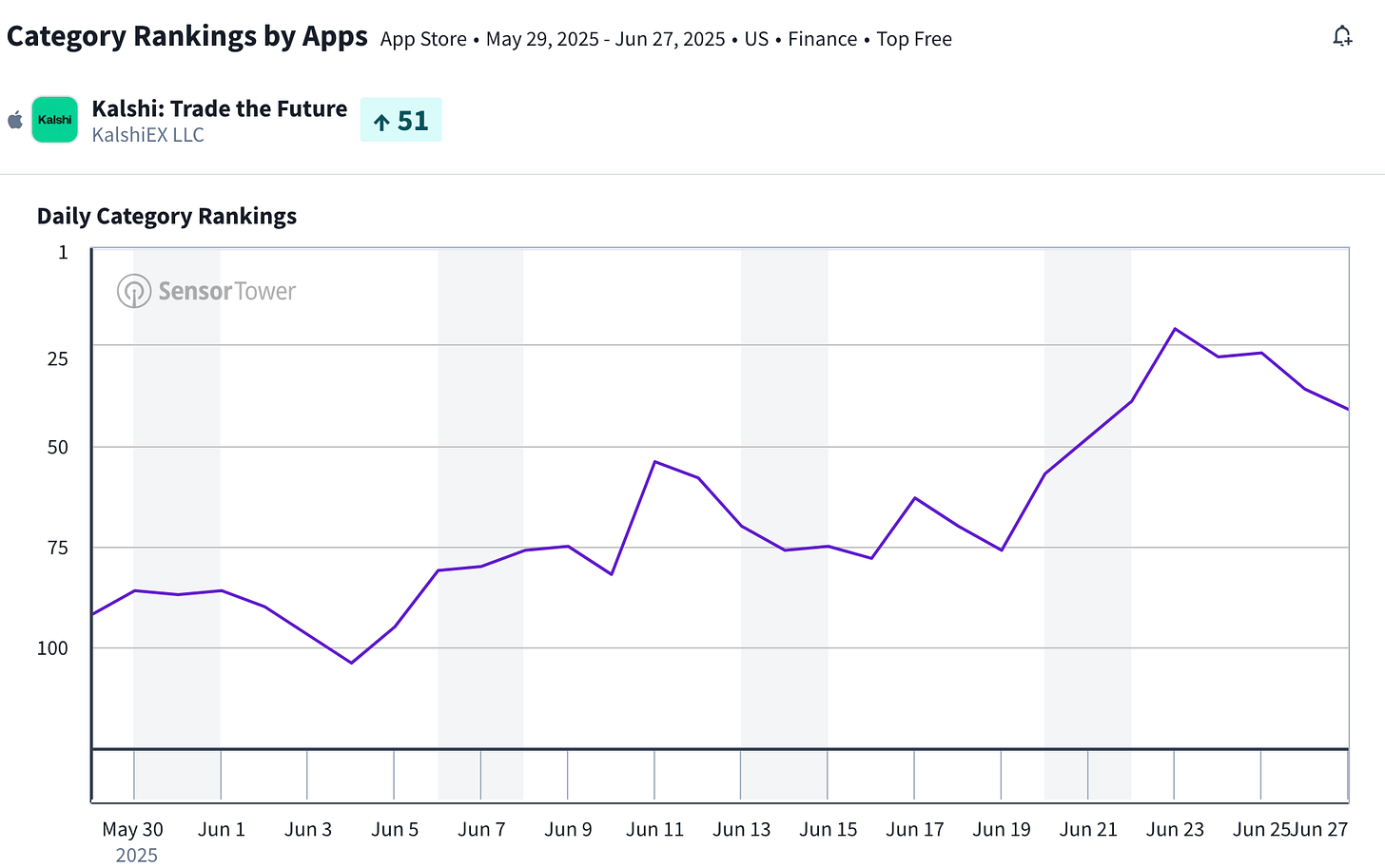

Kalshi continues to perform well in downloads for free finance apps in the App Store. As of Thursday night it sat at No. 42, but it was as high as 21 earlier this week, according to Sensor Tower. Kalshi has ticked up to 70,000 downloads over the past month, up from 60K. For comparison, Robinhood is recently in the 20s by rank and 300K downloads per month.

As competition heats up, can prediction markets crack the parlay? (Next.io): To dethrone the house, however, Kalshi and other platforms like Crypto.com must overcome a major hurdle: Can prediction markets crack the parlay?

Goldman Sachs is using Polymarket: “Prediction markets, despite limited liquidity, reflect a 52% probability of Iran closing the strait this year, Goldman said, citing data from Polymarket. About a fifth of the world's oil consumption passes through it. ‘While the events in the Middle East remain fluid, we think that the economic incentives, including for the U.S. and China, to try to prevent a sustained and very large disruption of the Strait of Hormuz would be strong,’ Goldman Sachs said.

Robinhood added Kalshi’s betting markets for the Nathan’s Hot Dog Eating Contest and UFC 317.

Last week I shared the New Finance Institute’s brief in the Kalshi vs. New Jersey federal case. They made a video about the history on the topic of sports event contracts and the CFTC and their thoughts:

Kalshi was featured at the New York Stock Exchange:

This is for people who are terminally too online, but the menswear guy who is very popular on Twitter has apparently been asked to weigh in on grading a market on Polymarket about whether Volodymyr Zelenskyy will wear a suit before July.

Ridiculous things you can

bettrade on at prediction markets:Polymarket: See the suit market above. Or: Will Trump launch a metaverse before July? Currently a 1% chance.

Kalshi: Will Dave Portnoy score any pizza place a 9 or higher again this year?