News: Trump Taps Kalshi Board Member To Head CFTC

Brian Quintenz famously disagreed when the CFTC wanted to stop ErisX from allowing NFL spread and moneyline contracts. And more news: WeBull is partnering with Kalshi to offer binary event contracts.

If you are bullish on the future of Kalshi and prediction markets, the new head of the Commodity Futures Trading Commission might make you even more bullish.

Bloomberg (paywall) reported that President Donald Trump plans to pick Brian Quintenz as the chairman of the CFTC. Quintenz later confirmed the news via social media.

Quintenz was a CFTC commissioner from 2017-2021. He will replace acting chairman Caroline Pham.

The appointment of Quintenz is being hailed as a win for cryptocurrency because of his background as the head of policy for the crypto arm of Andreessen Horowitz (a16z).

But it appears to be equally good for the future of prediction markets and Kalshi. Quintenz currently serves as a board member at Kalshi, and has also served as an advisor at Crypto.com. (Crypto.com launched sports event contracts in late 2024; Kalshi followed last month).

Things had already been trending well for Kalshi under Pham, who had said she wanted the CFTC to "foster thriving prediction markets.” Additionally, Kalshi had brought on Donald Trump Jr. as a strategic advisor.

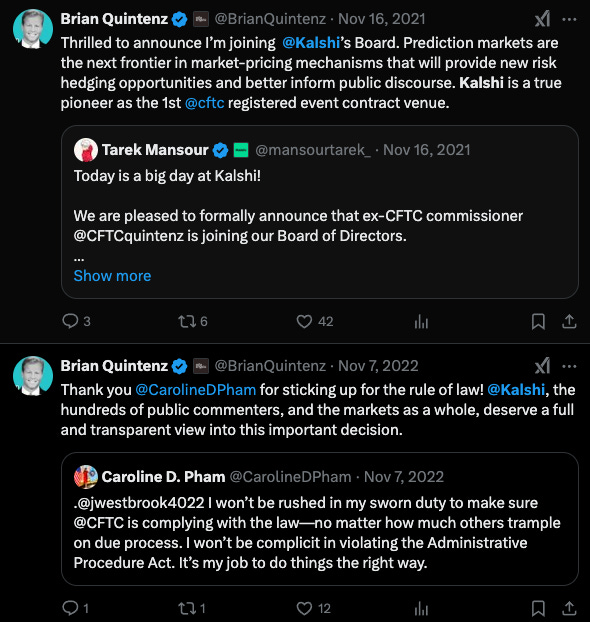

Here are some tweets from Quintenz from the past on Kalshi:

And Kalshi CEO Tarek Mansour celebrated the news.

Quintenz on NFL event contracts

Interestingly, Quintenz was with the CFTC in 2021 when derivatives exchange ErisX self-certified markets based on the spread, moneyline and scoring totals of NFL games. Part of the idea behind the effort then was to provide hedging tools to legal sportsbooks.

At the time, the CFTC had reportedly prepared an order to force ErisX to pull these markets down, but ErisX pulled them on its own before the order was issued.

After all of this, Quintenz said in a lengthy official statement that he would have dissented from the order stopping ErisX and its NFL contracts. Here are several relevant excerpts (I added emphasis in bold):

“I would have dissented from the Order prohibiting the ErisX NFL contracts due to significant concerns around the statute’s constitutionality, the regulation’s validity, and the order’s arbitrariness. Customarily, my dissent would be made moot by virtue of ErisX’s withdrawal, and my ability to comment on the Order therefore nullified. But, because of the severity of these concerns and their implication for any future event contract filing, I feel compelled to release this statement to bring transparency to this debate and process. So….are you ready for some football?”

…

Before we get into the specifics around ErisX’s NFL contracts and the Constitutional and administrative issues with the statute, regulation, and the Commission’s proposed Order, let me take a minute to dispel two notions: that taking an economic position on an event’s outcome is legally equivalent to a gaming/gambling activity, and that there is no fundamental or qualitative difference between gambling and speculating. Understanding these points may help to better define what our markets are truly meant to do and why participants in them, regardless of their motives, are vital to it. …

First, it is not the case that trading an event contract with a binary outcome is automatically considered a bet, wager, or gamble from a regulatory perspective.

…

There are plenty of events that have a discernable and legitimate economic impact and whose probabilistic outcomes can be estimated through an analysis of relevant factors. That could now be just as true for sporting events as it is for oil, corn, or gold production. Try telling a professional sports team’s general manager (or even die-hard fantasy footballers) that their outcomes are purely chance driven. Post Moneyball, GMs analyze statistics until they are red-eyed to try to get an edge, just like professional investors.

On how arbitrary the use of “the public interest” can be in trying to stop ErisX sports contracts:

The “public interest” could be a moral consideration. It could be an interest based on financial stability, the integrity of sporting events, enhancing the regulatory apparatus around sports betting, or even, perhaps, increasing fair access to gaming. And there can be competing interests amongst the public. To the public that enjoys sports betting, a contract that makes their interest easier, safer, or cheaper, is in the public interest. However, that same contract is contrary to the interest of the public that is opposed to sports betting.

And from the conclusion:

However, from a first principles perspective, if the decision is that important to the use of agency resources, the challenge to the agency’s expertise, and explosive broadening of the agency’s markets, it is also likely the best catalyst for Congress to properly reclaim its legislative power and either ban such contracts outright or provide a detailed framework through which the agency can appropriately fact-find on specific contract cases. But no such prohibition should ever be made by a flawed and non-transparent administrative order pursuant to an APA-violating regulation based on an unconstitutional statutory delegation. …

The growth, power, and discretion of the administrative state, the usurpation or delegation of legislative powers from Congress, and lack of accountability to the electorate provided thereby has been a statute-by-statute game of inches that Article 1 has been losing over decades. We need to call an officials’ time-out, go to the replay booth, reset the clock, and ensure that the game is being played according to the rules of the Constitution. That would truly be “in the public interest.”

Of course, what Kalshi is offering for sports event contracts — where anyone with a Kalshi account can trade on the outcomes of sports events markets — is arguably much different from what ErisX was attempting to do at the time. This from his statement is perhaps most relevant to parsing his potential thoughts on sports contracts at ErisX vis a vis Kalshi.

…speaking in broad policy terms and putting aside the voluminous technical and legal nuances, there are qualitative and logical distinctions between speculation and betting. Whereas bettors participate in games of pure chance, whose sole purpose is to completely reward the winner and punish the loser for an outcome that would otherwise provide no economic utility (think roulette), speculators in the derivatives market participate in non-chance driven outcomes that have price forming impacts upon which legitimate businesses can hedge their activities and cash flows.

No matter what, Quintenz will take over at the CFTC with sports event contracts looming over the commission as a major action item.

Webull to list Kalshi event contracts

Webull, a leading digital investment platform, today announced that it has partnered with Kalshi, the first CFTC-regulated exchange with prediction markets. The partnership will offer users the ability to trade binary event contracts through the Webull platform. …

"Event contracts are the next evolution of financial markets, and we are excited to partner with Webull, a leading broker in the US, to bring this next generation investment opportunity to traders," said Tarek Mansour, co-founder and CEO of Kalshi.

According to Bloomberg, sports contracts will not be part of the offering.

Press release here.