News: Kalshi Announces Sports Integrity Monitoring, Responsible Gambling Protocols

Prediction market platform has a deal in place with IC360 for sports event trading and launches a consumer protection hub.

The prediction market platform Kalshi is announcing two pieces of news on Monday designed to blunt pushback against its business model on a pair of important fronts: game integrity related to sports betting and responsible gambling.

Kalshi will announced an integration with IC360, the technology firm that works with the regulated sports betting industry, for monitoring of suspicious activity as it relates to trading sports events contracts on its platform. While the announcement of the integration is new, Kalshi says that the relationship has been going on for a month.

The deal includes the use of ProhiBet, which is designed to stop athletes, coaches, trainers, team employees and administration from attempting to bet at sportsbooks, and now if they try to trade on games via prediction markets.

The company will also announce the launch of a new "customer protection hub" that will help with concerns beyond just sports betting, although all of these concepts have a comp in the regulated gambling industry:

Users will be able to exclude themselves from trading on Kalshi, called "voluntary opt-outs.”

Users can also initiate "trading breaks,” where they remove themselves from being able to trade on Kalshi for a set time limit.

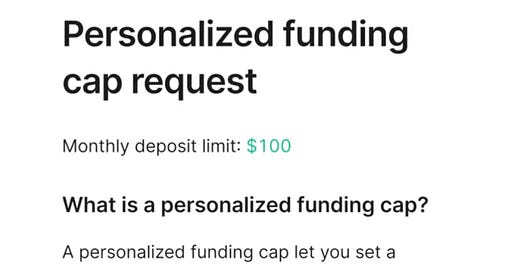

Users can set "personalized funding caps" that enable them to set a maximum deposit limit for their account.

Here’s a video of how these functionalities will look on the site:

The paired announcements come at a crucial time for Kalshi in particular and prediction markets in general as both further expand into sports gambling. Two of the biggest criticisms of the nascent offering from Kalshi stem from responsible gambling and game integrity issues. Both are arguably less of an issue with these revelations.

Kalshi still faces pushback on a number of fronts:

Its legality under and intersection with both state and federal laws, including the avoidance of taxes and regulatory regimes in the former.

From segments of the regulated gambling industry, including tribal gaming and the American Gaming Association. Sportsbooks themselves have been more non-committal on prediction markets, which could offer an opportunity to expand their addressable markets.

Potentially from the NCAA, which has been calling for bans on college betting either in full or in part; trading volume on the college basketball tournaments, aka March Madness, has already eclipsed $200 million.

The contours of what is to come on sports event trading are likely to be shaped via a Commodity Futures Trading Commission roundtable that The Event Horizon understands is scheduled for April 30.