CFTC Nominee Releases Texts With Winklevoss Twins

Brian Quintenz's confirmation process has been stuck in limbo; will this break the logjam? Roundup: Oral argument takes place in Kalshi vs. New Jersey; AGA releases survey data on prediction markets.

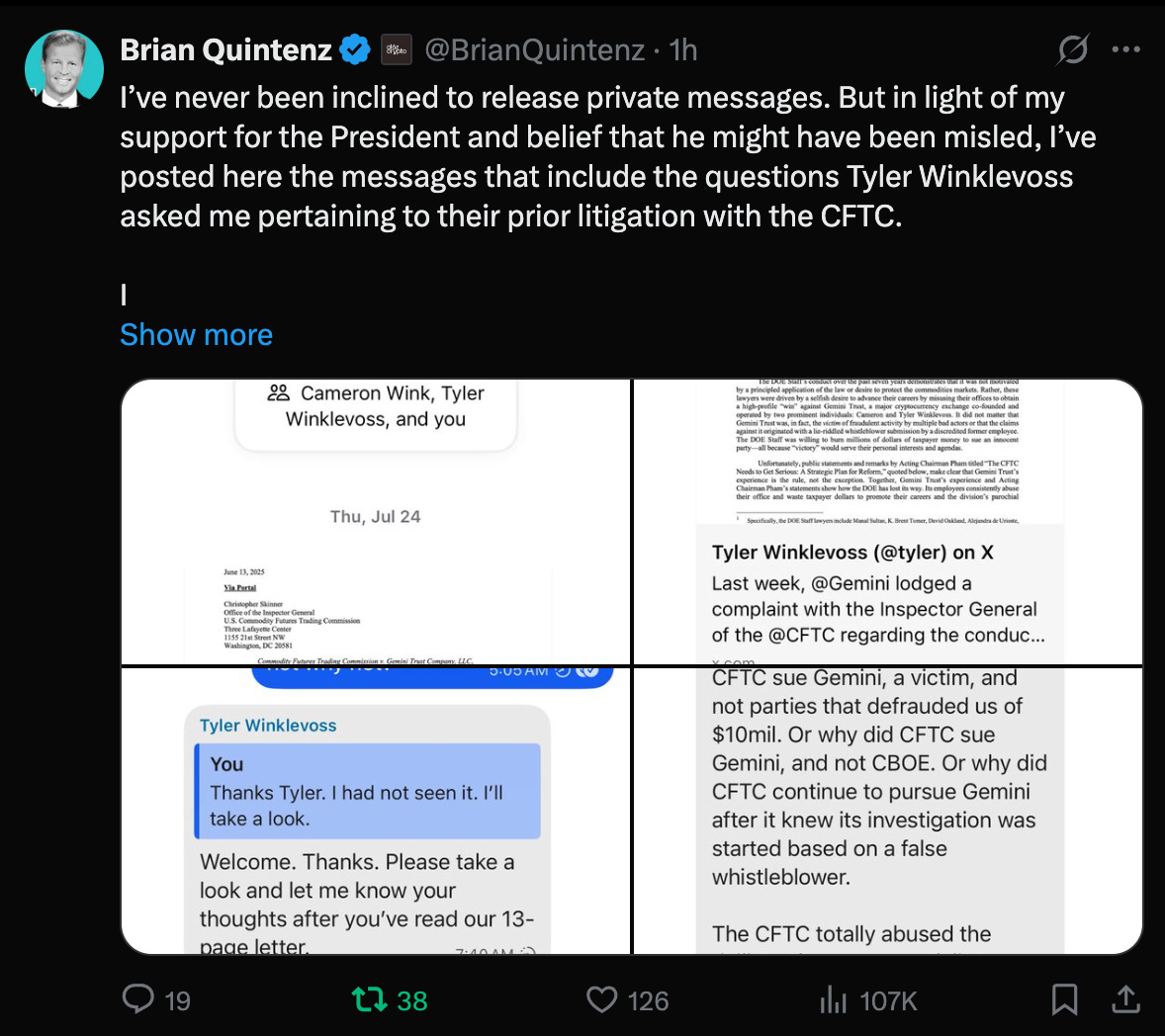

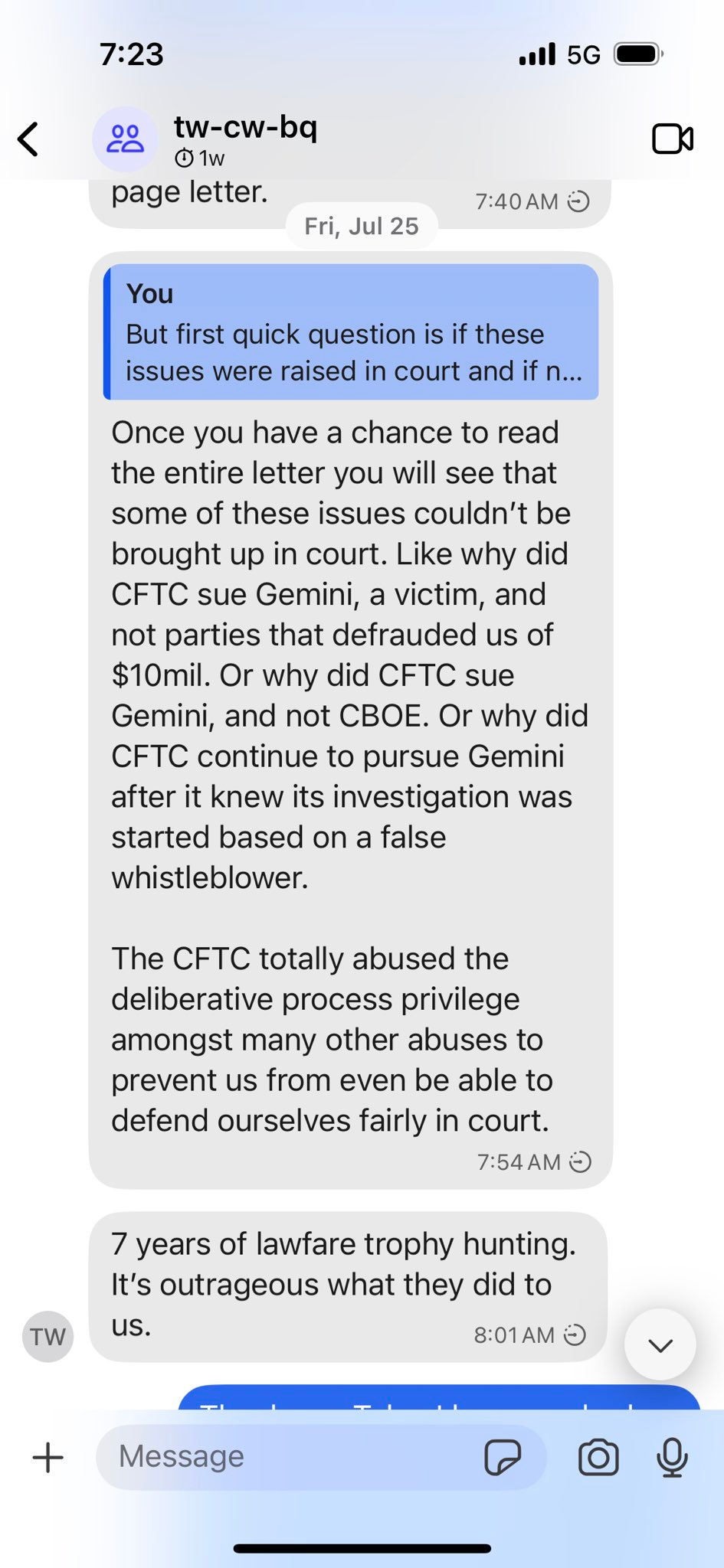

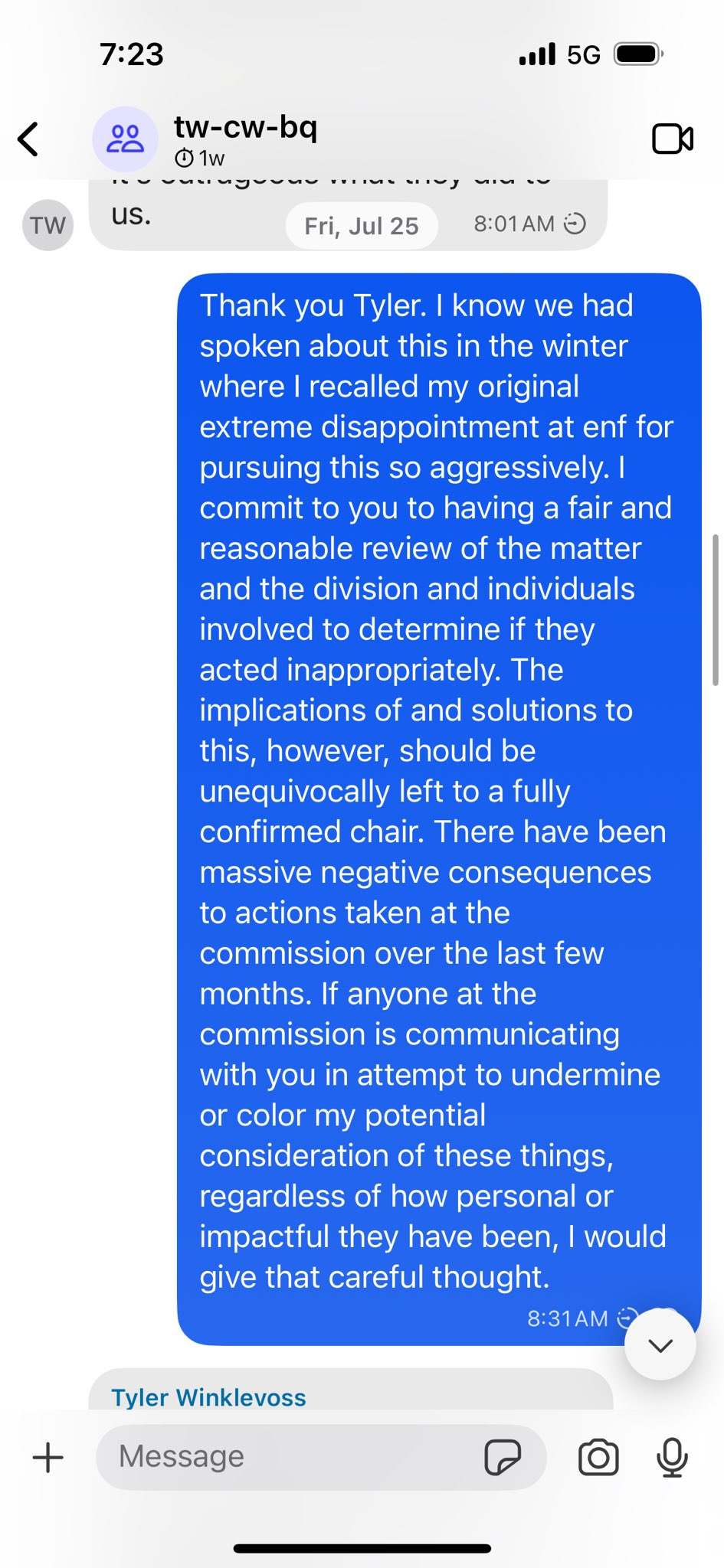

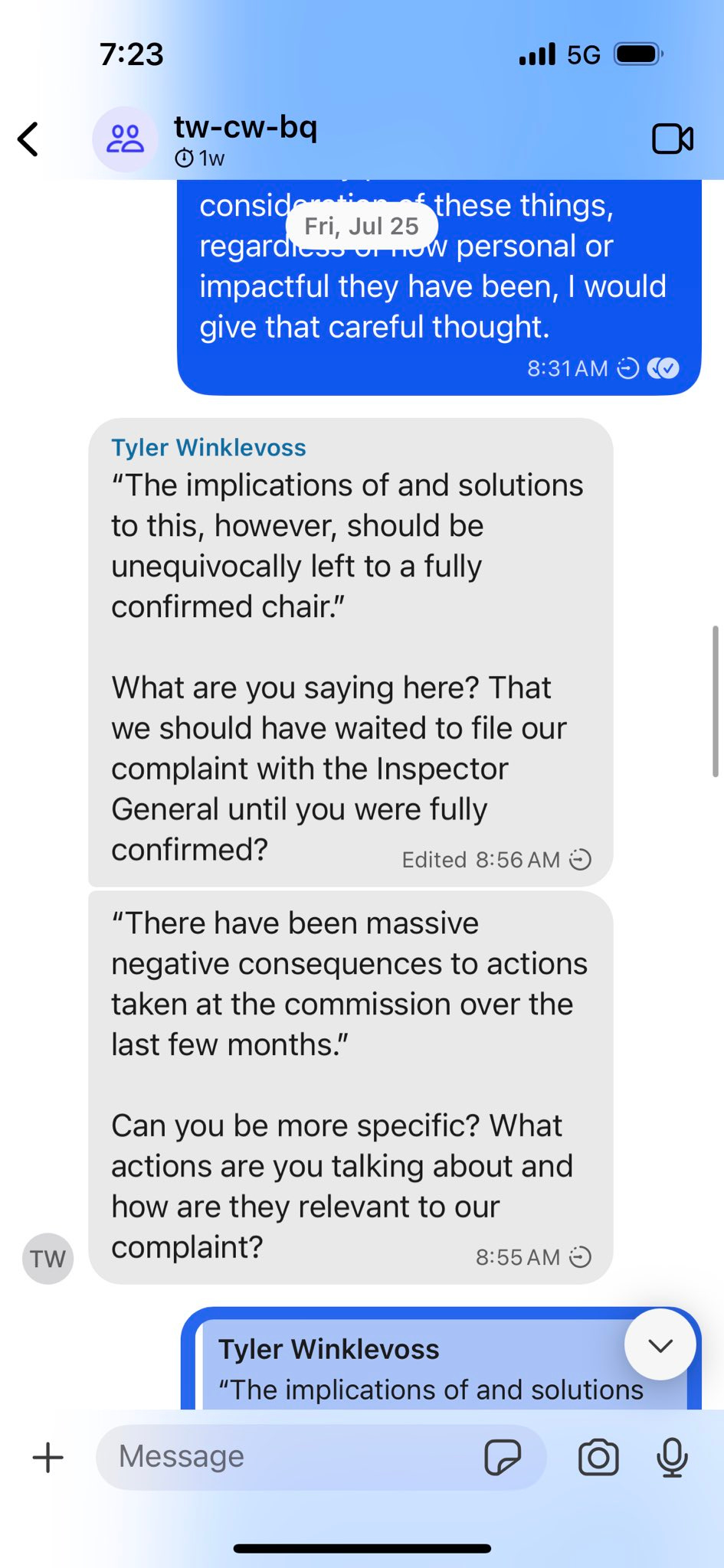

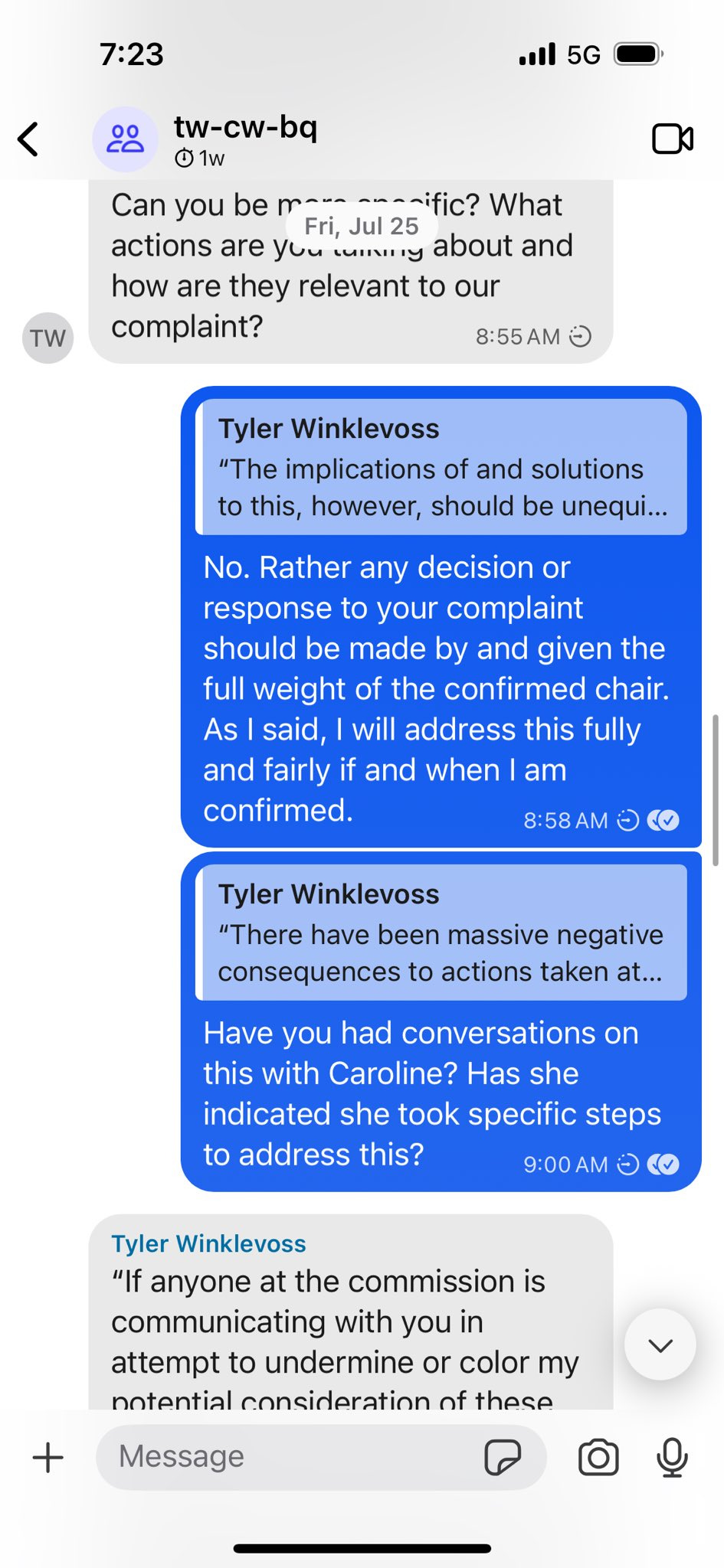

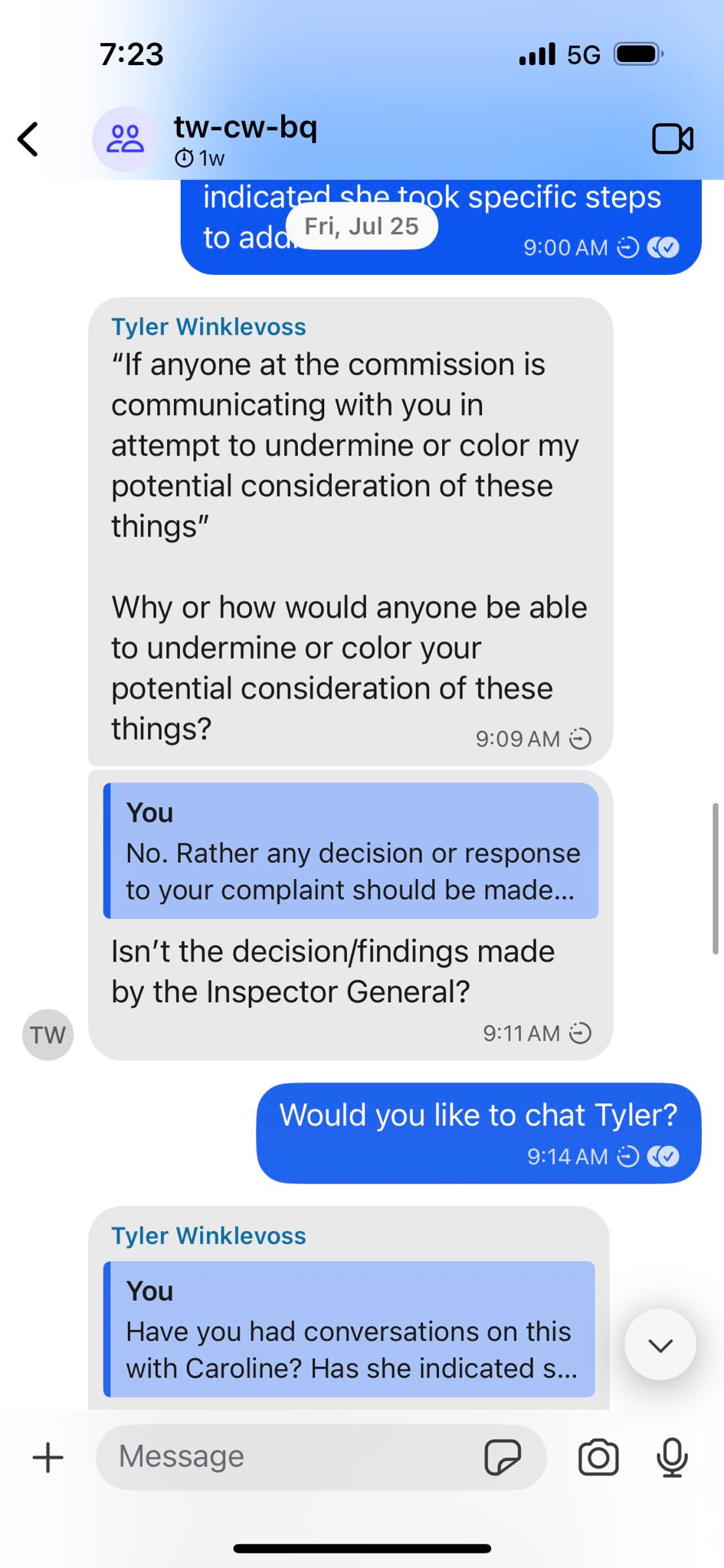

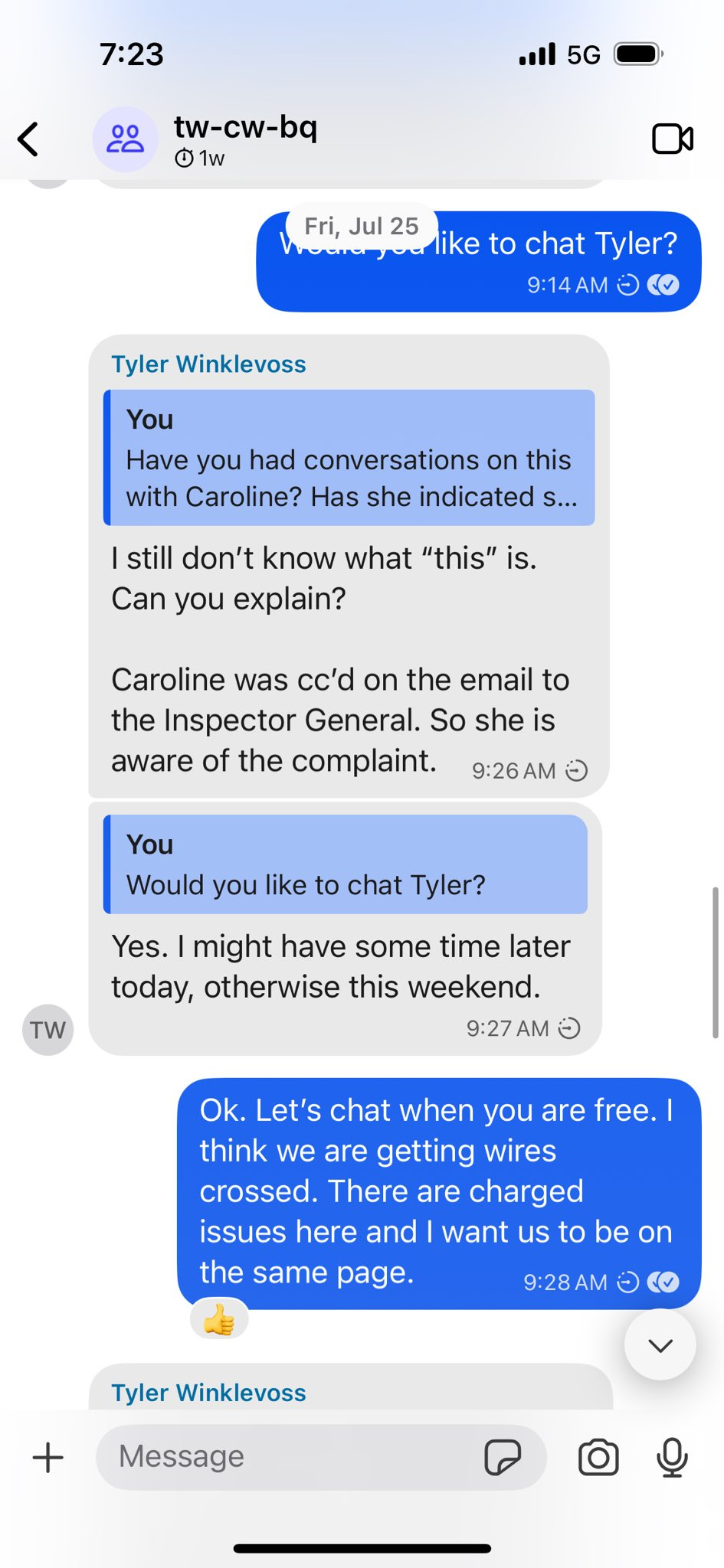

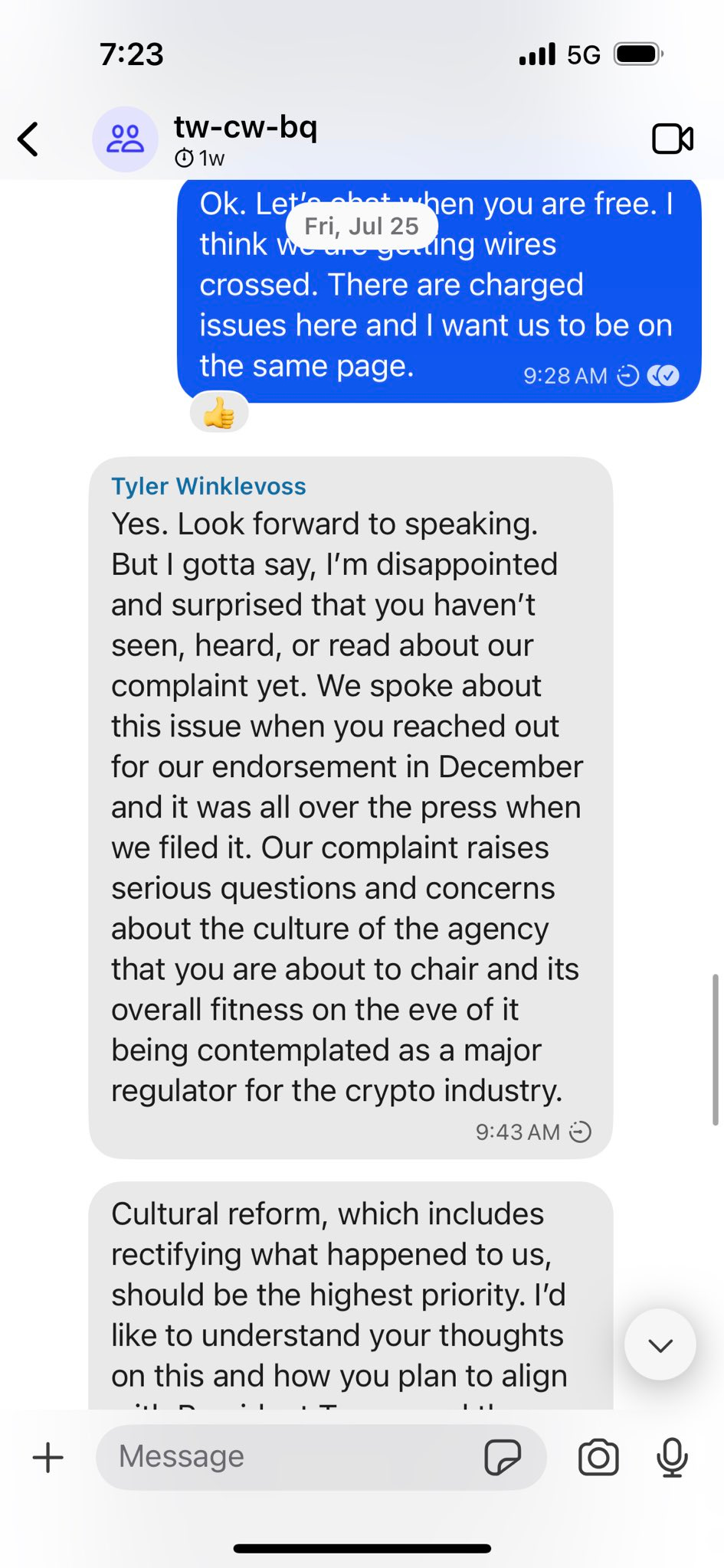

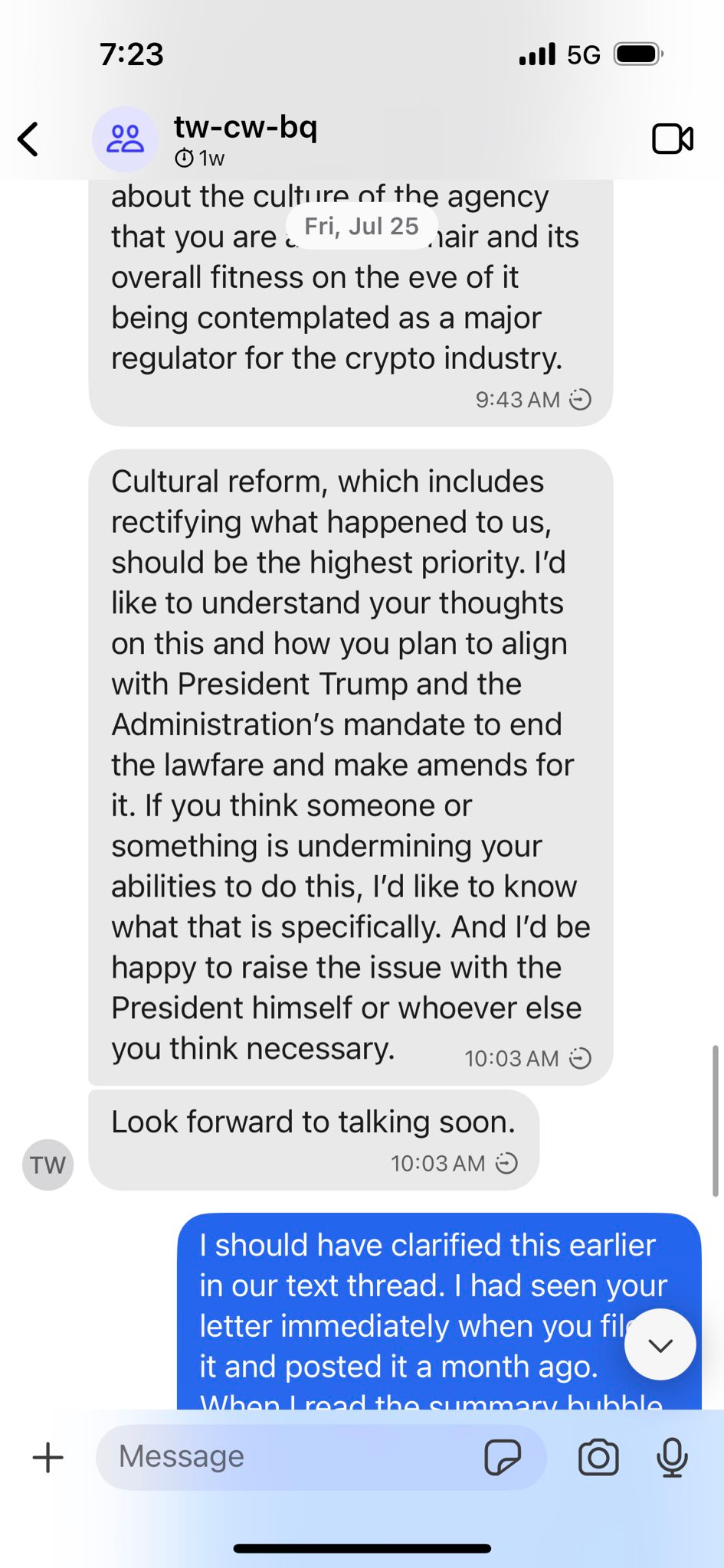

The nominee to lead the Commodity Futures Trading Commission posted screenshots of a Signal chat history with the Winklevoss twins — the co-founders of the Gemini cryptocurrency exchange — on Wednesday.

Quintenz’s nomination to chair the CFTC has been stalled for six weeks, reportedly stemming from pressure on President Donald Trump from the Winklevosses to reconsider his nomination. The release of the text messages would seemingly be designed to break the logjam on Quintenz’s nomination. (The CFTC is the regulator of prediction markets; Quintenz is a Kalshi board member.)

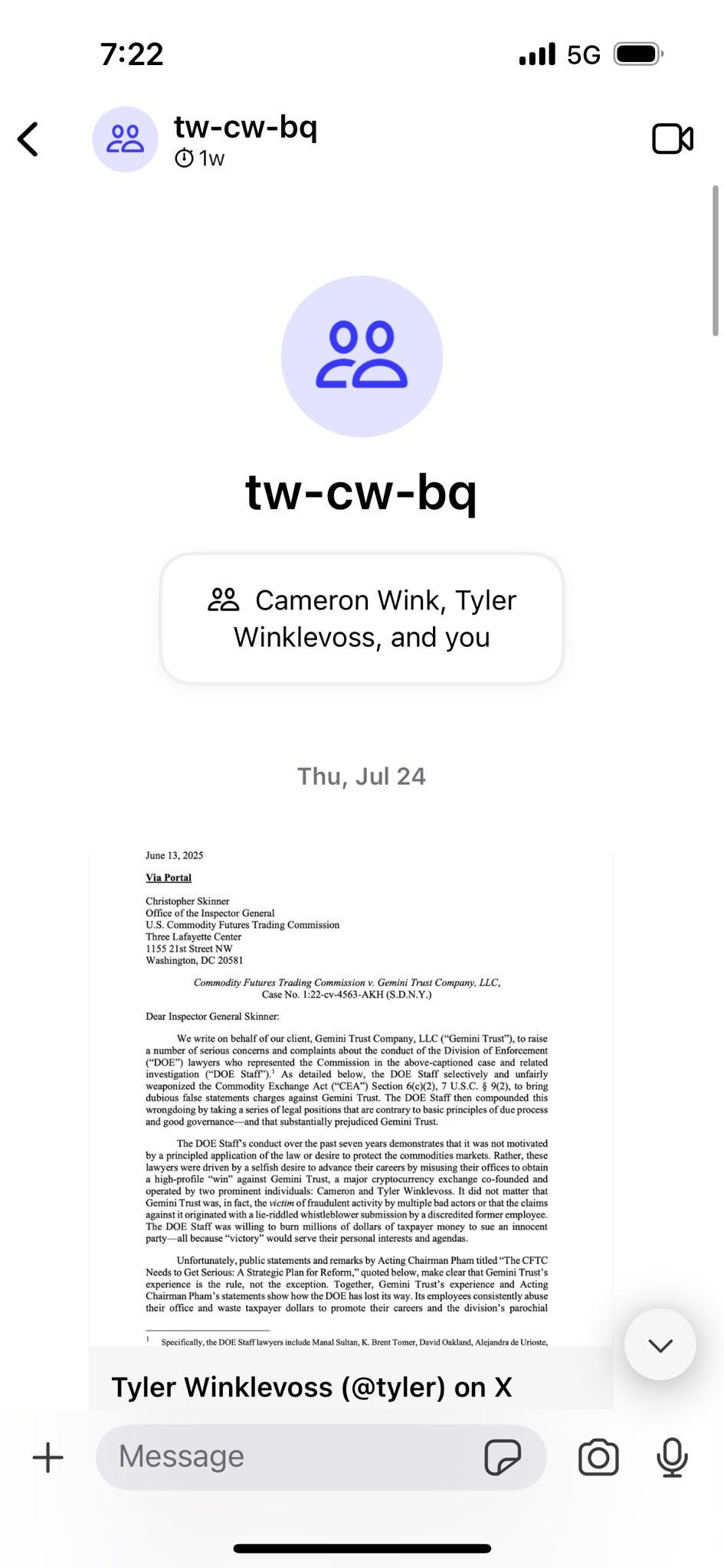

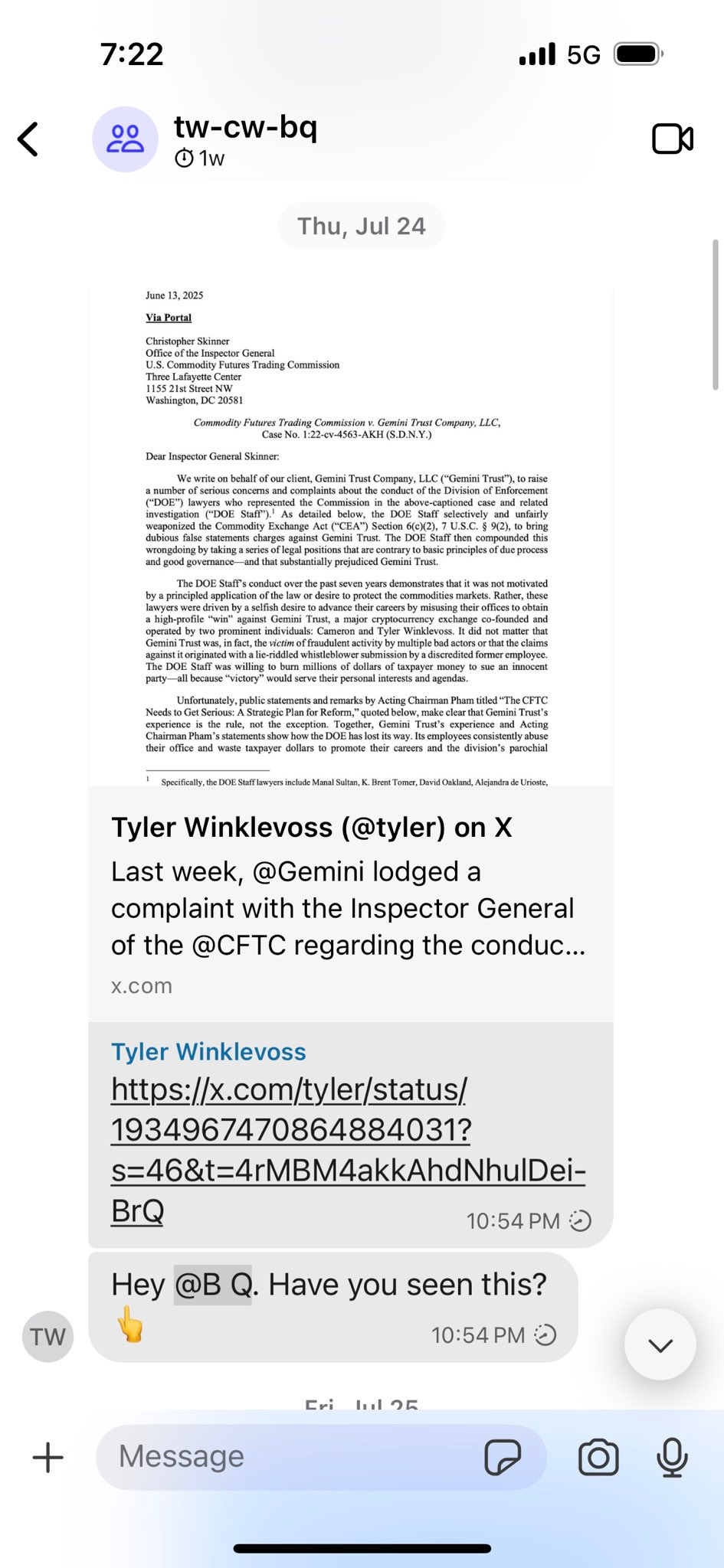

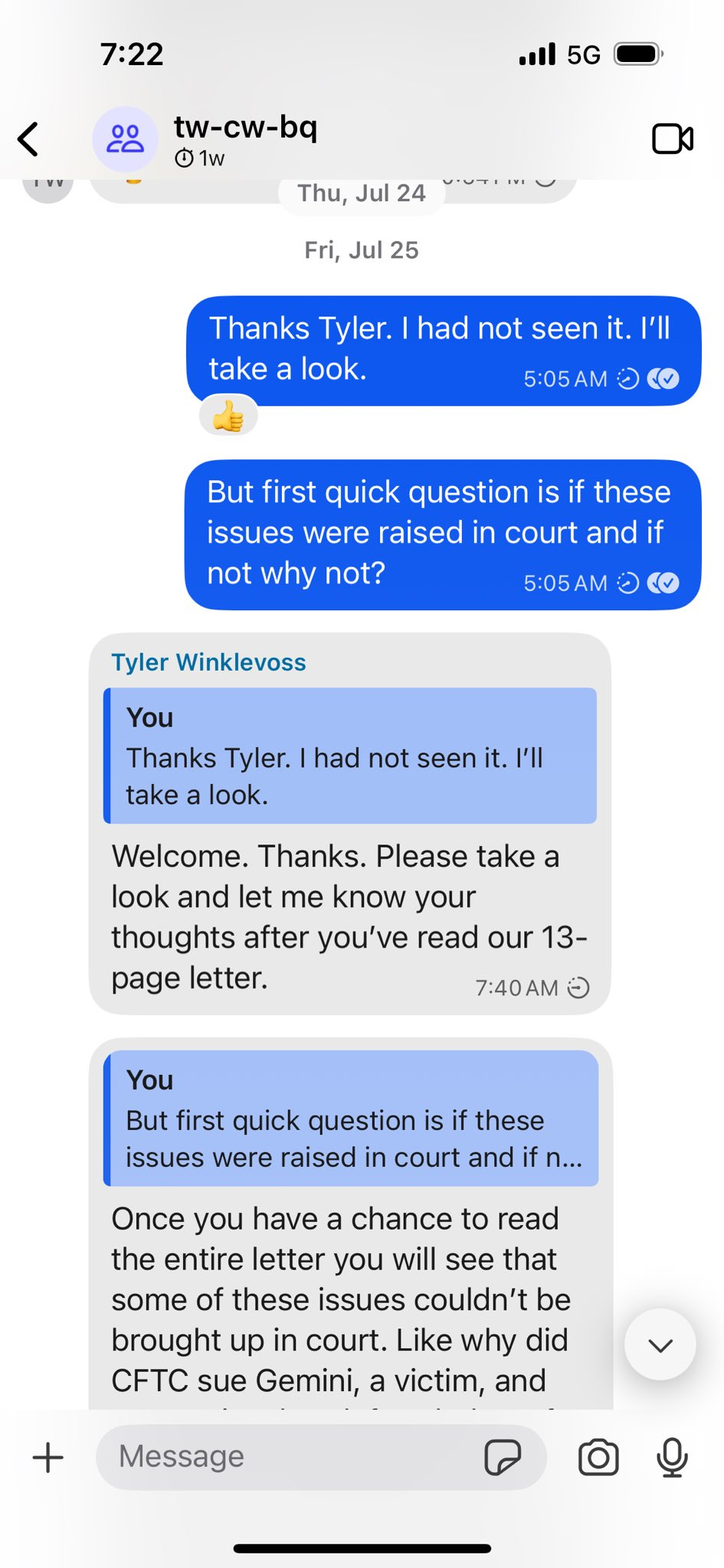

The messages Quintenz posted deal with the CFTC’s handling of Gemini. Gemini is on the cusp of its IPO.

Here’s what Quintenz wrote on Twitter:

I’ve never been inclined to release private messages. But in light of my support for the President and belief that he might have been misled, I’ve posted here the messages that include the questions Tyler Winklevoss asked me pertaining to their prior litigation with the CFTC.

I believe these texts make it clear what they were after from me, and what I refused to promise. It’s my understanding that after this exchange they contacted the President and asked that my confirmation be paused for reasons other than what is reflected in these texts.

I believe transparency and integrity are paramount. Protecting the President and his agenda are more important than any job.

I am proud to have consistently supported President Trump since 2016, having served in his first administration and on the transition team for his second administration, and through my recent nomination process and confirmation hearing testimony in front of the U.S. Senate. I look forward to continuing to support his agenda in whatever capacity I can.

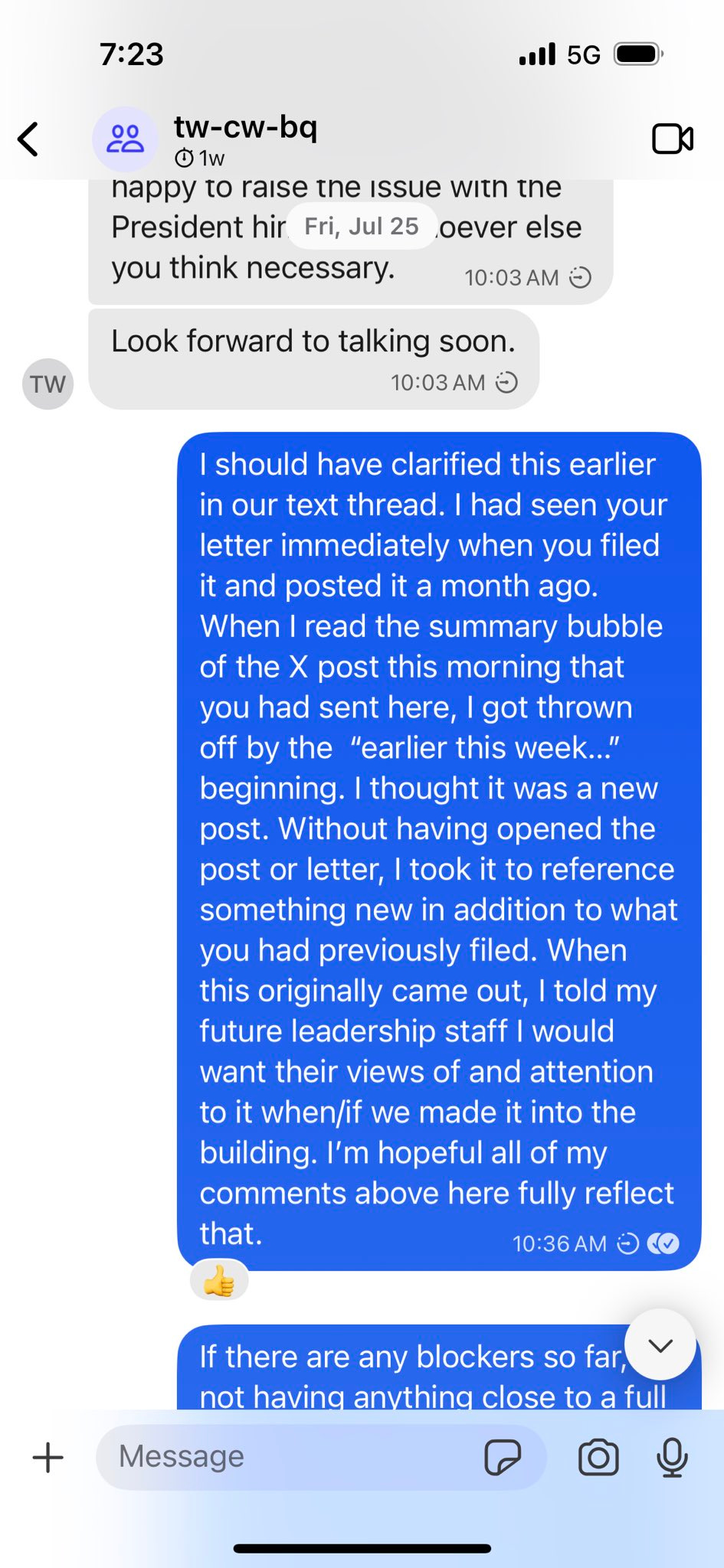

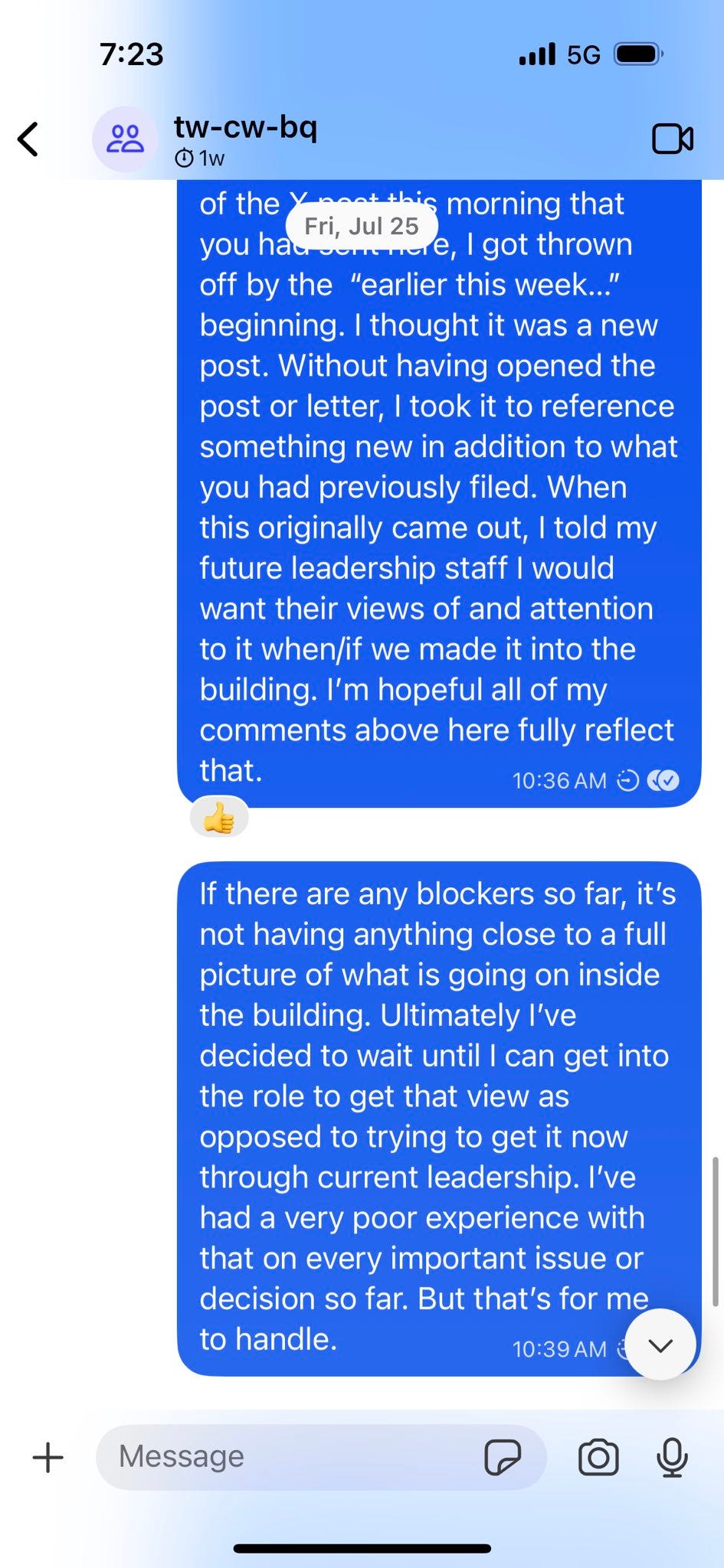

The texts that Quintenz released came on July 24-25, just before his nomination started meeting resistance. A planned vote in the Senate Agriculture Committee to advance his nomination was scrapped later that week. Reporting then indicated this happened at the behest of the White House, which has still been publicly supportive of Quintenz.

Whether this changes his prospects is unclear. But by posting private messages, Quintenz seems to have written off regaining the twins’ support.

Here are all the messages Quintenz posted:

Prediction markets news roundup

Oral arguments take place in Kalshi vs. New Jersey: One of the big court cases involving the future and legality of prediction markets is on appeal in the Third Circuit. New Jersey has said Kalshi is offering illegal sports betting, and Kalshi sued to stop enforcement; Kalshi won on its preliminary injunction in district court, and NJ appealed. More to come later at The Event Horizon from attorney Andrew Kim, who attended the arguments in person. For now, here’s what he has on Twitter:

“My initial reaction is that I’d rather be Kalshi than New Jersey. Judges Chagares and Porter seem inclined in Kalshi’s direction, but were thinking about where to draw the line between sports bet v. swap. The two judges were, at various times, nodding along to what Kalshi’s lawyer had to say. I don’t think the judges were buying New Jersey’s hyperbolic “everything’s a swap” argument at all.

The two tipping points for me were: Chief Judge Chagares asking Kalshi's counsel which preemption framework is best, field or conflict. Judge Porter noting to NJ that Kalshi need only demonstrate that the PI standard is ‘significantly better than negligible’ on the merits.

My sense is that Judges Chagares and Porter are having some difficulty with Kalshi's field preemption argument, and may be inclined to go towards conflict preemption. Porter seems to be focused on the coexistence of sports betting + event contracts, and where to draw the line.

I'd like to listen to the argument again before drawing any firmer conclusions, but here's what I'm curious about post-argument:

1. Does the court try to draw any lines on when a sports bet is no longer a ‘swap,’ i.e., contracts PMs can't offer?

2. If NJ loses, given the preliminary posture of the case, does the court leave open a path for NJ to win? (Hard to see that given how NJ has litigated the case, but maybe.)

3. If the court tries to do 1, does that exercise reveal the difficulties of preemption here, maybe swinging this case back toward NJ's direction

One other thing worth noting is that the fact that Kalshi's lawyer got zero questions on the presumption against preemption indicates that this panel probably isn't joining Judge Abelson in Maryland...”

Bloomberg (paywall) also covered the arguments.

American Gaming Association: ”Four in Five U.S. Voters Say Sports Events Contracts Should Be Regulated Like Other Online Sportsbooks” (press release): The AGA has been actively lobbying against the rise of sports betting via prediction markets, although the path to effectively lobbying is unclear. The traditional paths of lobbying Congress or the CFTC directly to effect change seem to be dead ends, leaving the AGA to position the issue through other means.

One of those means is through this survey on public sentiment, which notes that a vast majority of people see prediction markets as gambling and that they should be treated as such, which is honestly pretty believable when you describe the product. I am sure Kalshi could run a poll tomorrow that would give us the opposite numbers, so I expect to see that soon.

Here’s the full press release below, and the data here:

WASHINGTON, D.C. — The American Gaming Association (AGA) today released new research showing strong sentiment that sports events contracts offered through prediction markets—online platforms where users wager on the outcomes of future events—should be regulated in the same way as other forms of legal, state-regulated sports betting. The study also shows that the public overwhelmingly view them as a form of gambling that requires oversight.

Key Findings:

Americans overwhelmingly recognize sports events contracts as gambling, not financial instruments. 85% say sports events contracts are most like gambling, while only 6% believe they are most like a financial instrument.

Most Americans want sports events contracts regulated like other forms of sports betting. 80% say that sports event contracts should be regulated like other online sports betting and 65% believe these bets should be overseen by state and tribal gaming regulators, not the federal Commodity Futures Trading Commission (CFTC).

Adults agree that sports events contracts should only be offered by state-licensed sportsbooks. 84% of Americans, and 69% of sports bettors, say that sports events contracts should only be available in state-licensed sportsbooks in the states where they are offered. 69% of Americans believe each state should have a say on whether sports events contracts can be offered in their state.

Americans recognize prediction platforms offering sports event contracts are skirting the law. 70% say prediction platforms offering sports event contracts are exploiting loopholes to act as unlicensed sportsbooks.

“This research has made it clear: Americans know a sports bet when they see one — and they expect prediction markets offering sports event contracts to be held to the same rules and consumer safeguards as every other state-regulated sportsbook,” said AGA President and CEO Bill Miller. “This underscores the need for the CFTC to enforce and uphold its own regulations that prohibit gaming contracts, and for Congress to use its oversight power to ensure prediction markets are not used as a backdoor for gaming.”

With sports betting currently operational in 38 states and Washington, D.C., AGA’s research emphasizes the need for consistent oversight of emerging gaming products to maintain consumer trust and uphold responsible gaming standards.