Army Journal: Prediction Markets Can Help Assess National Security Threats

Prediction markets = intelligence tool?

Yes, according to a new article at the Military Intelligence Professional Bulletin, a quarterly journal published by the US Army. The journal is “designed to keep intelligence professionals informed about current and emerging developments within the field and provides an open forum” for the exchange of ideas.

A current captain in the Army and a retired commander in the US Navy co-wrote the piece, which you can download below or read here.

From a summary of the article at the bulletin’s website (where the piece is the featured article of the month):

Discover the power of prediction markets! This article explores the concept and operation of prediction markets, which aggregate diverse opinions to forecast events like elections, economic indicators, and geopolitical developments. By utilizing platforms such as Polymarket and Kalshi, intelligence professionals can leverage trading data to gain insights into national security threats, offering a dynamic and real-time addition to traditional intelligence sources. The piece discusses how prediction markets enable analysts to extract valuable information from contract trading, assess probabilities, and enhance their analyses through innovative techniques. It concludes by contemplating the future evolution of prediction markets and their increasing significance for intelligence work.

The idea isn’t exactly a new one; an article in a CIA journal almost 20 years ago espoused the idea of using prediction markets to inform intelligence efforts as well:

The bulk of evidence on prediction markets demonstrate that they are reliable agregators of disparate and dispersed information and can result in forecasts that are more accurate than those of experts. If so, prediction markets can substantially contribute to US Intelligence Community strategic and tactical intelligence work.

The new article offers several different areas where prediction markets can be useful to intelligence professionals:

Military conflict

Regime changes

Economic sanctions

Cybersecurity incidents

Incidents that can cause civil instability (natural disasters, pandemics, etc.)

Interestingly, the authors advocate for markets on regime changes, something that has been controversial in the short history of prediction markets:

Contracts that predict changes in political leadership, such as elections, coups, or resignations, are crucial for understanding potential shifts in national policies or alliances. A contract forecasting the likelihood of a regime change in a Middle Eastern country, for instance, can signal impending shifts in diplomatic relations, security agreements, or regional power dynamics.

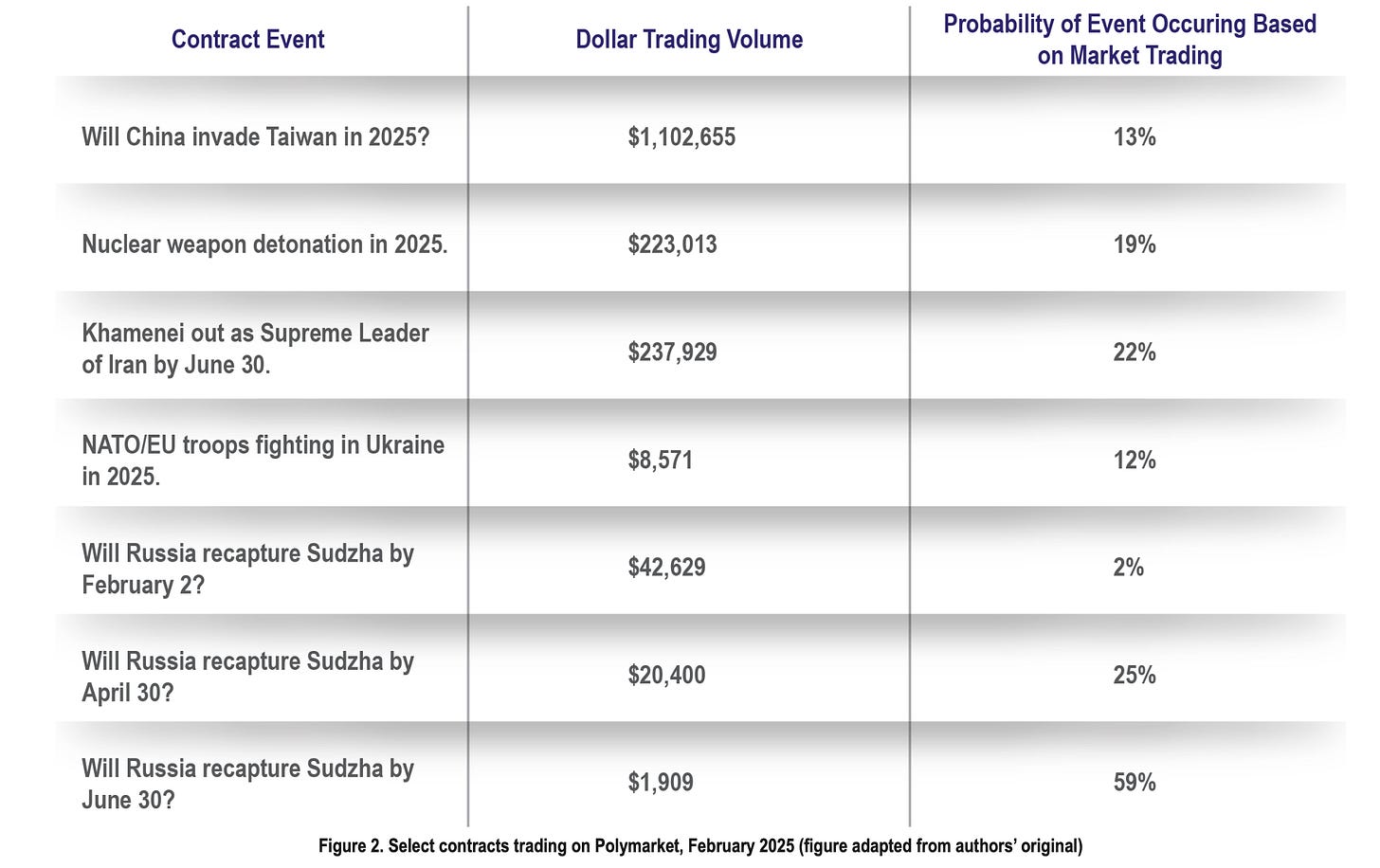

While not naming “assassinations” per se, that’s certainly something that could fall into the bucket above. To date, more of these markets have been posted at Polymarket, which isn’t offered legally in the US, than Kalshi, a market regulated by the Commodity Futures Trading Commission. The latter has stayed away from some of these types of markets. A table from the article:

Putting that aside, the article makes a case for incorporating prediction markets into intelligence analysis.

The potential benefits of incorporating prediction market data into national security analysis are compelling. As these markets continue to evolve, they are likely to become increasingly valuable to the intelligence community, allowing it to more fully anticipate emerging national threats. The future of national security intelligence might well depend on our ability to effectively harness these new sources of collective intelligence, combining them with traditional methods to create more accurate, timely, and actionable threat assessments.

I am certainly not an expert on prediction markets’ use in intelligence, but I think the article skips over one important idea. It doesn’t address the idea/possibility that people with insider information could be trading on these types of markets, which could be problematic but also makes the data from prediction markets more useful.